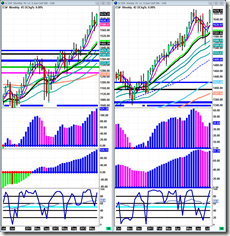

Russell Chart -- S&P 500 Chart

Quick note on these chart links, if you click the magnifying glass in the lower right hand corner, it will get bigger. Then if you click it again, it will show the original image size.

Stock indices are clearly ripping again off of that monthly buy signal at the close of the month on the Russell. The S&P though is still lagging and hasn’t broken through the highs like I have been looking for. Obviously from the trends there is no choice but to be bullish as even the immediate backup is still doing it job. S&P fast trigger did fire off so that is a good sign we will be breaking the highs. Russell right now is sitting at yearly R3 and that really tells me there is not a whole lot of more room this market is going to run this year. People are going to want to book these profits at some point, bulls make money, bears make money, pigs get slaughtered. What could be bad is if everyone is getting so greedy that it takes over their mind until there is some obvious reason that people need to be booking profits and all of a sudden everyone hits the exit at once. But for now I am just going to be watching the fast moving averages to hold and continue to push the trend upwards. Simple as that.

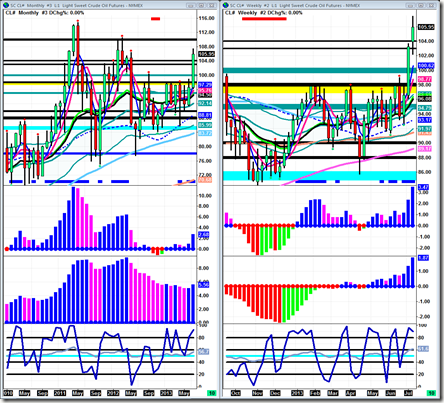

Crude Oil:

Crude Oil Chart

Crude oil doing a very good job of keeping its promise to me that it is in a bullish trend. Fast moving averages would ideally be snug behind price but these bars are such a wide range that it is lagging behind a bit. I’ve been looking for a small pause and still am but that doesn’t mean it won’t keep moving higher. I think at the first sign of a buying opportunity people are going to be taking it. It is going to be a buy the dip market for a while if everything goes to plan. $110 is the last resistance mark before there is nothing but air above and there is no real resistance holding it back. Also look at how strong the triggers are specifically the weeklies. A huge spike in the triggers like that doesn’t tend to just fade away, that is a sign of the beginning of a strong trend as I have been anticipating. It is basically the same strategy here as is the stock index futures, continue to look for the fast moving averages to hold price in an uptrend.

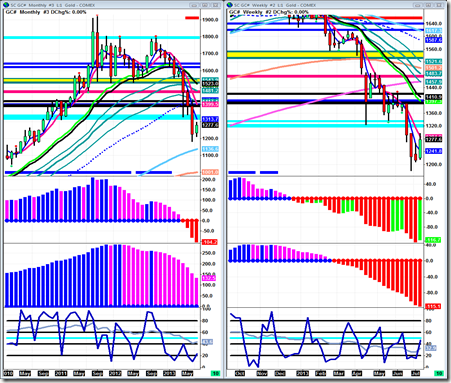

Gold:

Gold Chart

Gold still in a strong downtrend. However, it looks like it is trying to get above the fast moving averages for the first time since March. This could really provide for a great rally back to the immediate backup at $1410. Fast trigger has also gone green and that could precede the slow trigger going green, at that point something could really get going to the upside. The weekly chart has some serious curling down on the long-term trend support but the monthly is still strongly up. So similar to the monthly crude chart in 2008, the monthly chart takes priority as do all higher time frames. For now, this week all I am looking for is those fast moving averages to hold price above them. Then after that we could look for a move back to immediate backup.

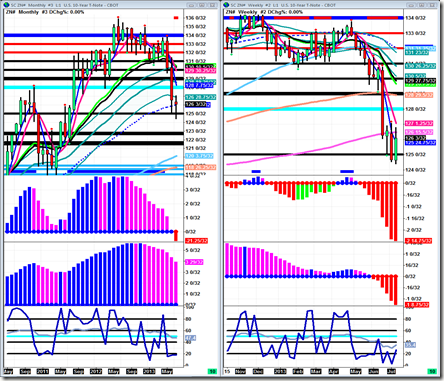

10 year note:

10 Year Note Chart

10 Year Note ChartI have been keeping up with the 10 year in these weekly recaps because it is in a very interesting spot here with rates being in the headlines and the massive sell-off after the Bernanke scare. There are one of two things that can happen here. Both are discussed in detail here in The 4 Components Of a Trend. One is that the monthly long-term trend support holds and pushes the price back above the weight of the market to continue an uptrend at which point interest rates would be below 0 (bit of sarcasm). The other scenario is the bouncing effect could take place on the weekly charts as media and the fed are getting very nervous about things, which I feel is a more likely scenario unless the brave Bernanke comes out with more QE before he decides to leave office. As far as this week goes, looking for the fast moving averages to contain price and act as a resistance on the weekly is probably a good idea. Maybe even look for a breakdown below the lows being that monthly and weekly triggers (aside from monthly slow) are all negative and red. Also weekly price is below 200sma so getting above that would put price above the fast moving averages and we can look for a test of the immediate backup which would also be a long-term trend support area and then we could see if the bouncing effect is being put in motion.

News for the week:

Picture of this week's news events

Link to Econoday website

See you next week,

-Michael