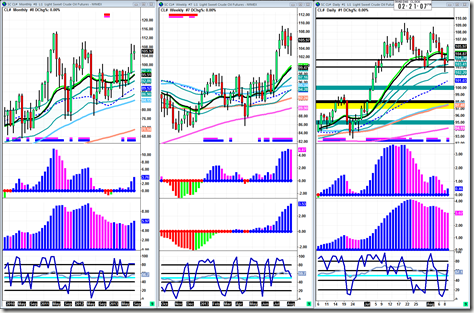

Stock Index Futures:

There are really no new signals to look at this week in the index futures, but we did get a failure pattern with a confirmed divergence on the daily charts. The S&P weekly chart divergence is also starting to play out with the fast trigger going magenta. The failure pattern being poking into new highs and coming back down showing that price wasn’t ready to break out again. I’m going to be watching the 20ema on the daily charts to be broken below to then get a test of the channel support and see how price reacts to that. You can see on the Russell monthly chart a pattern going on; one green month, one red month (consolidation). If that continues, this month is going to be the red consolidation month. Market internals are showing that to be a strong possibility. Looking at the weekly charts, every stochastic spike down has been bought and price is working on giving another one of those signals. This weeks price action will be a key factor in how that plays out. Also note the daily slow triggers, showing very clear loss of momentum. Bottom line is no trade signals this week but I am watching for one to form and that would entail breaking below the daily 20ema or $1040 level giving a nice sell off.

Crude Oil:

Crude oil did very well this week. It gave accumulation on the weekly and reacted very well to daily support levels. The 50sma on the daily is coming up right below it showing that price has relaxed itself enough to make another run. Everything is still looking good. There weren’t any signals given or much to update about at all, just some good old fashioned consolidation after a nice run.

Gold:

Finally gold weekly slow trigger printed green. Sellers really aren’t getting the job done as they were for a while there. That is not to say buyers are either. It is just a turf war going on right now. On top of that, if buyers did win the turf war, they still have a ton of resistance to get through. I mean it’s everywhere, just look at the charts through the time frames. Price on the weekly chart hasn’t touched the 20ema since the first week of February so there is almost definitely going to be sellers lined up there. Taking it one step at a time though, bulls are finally working through the daily 50sma and can likely get through the 1320 & 1340 resistance to test the 1370 long term resistance which is also strong weekly resistance. So that is what I will be watching for this week. If bulls loose and selling takes over, (which I don’t see as a very likely situation) well that is a pretty easy situation to handle. Nothing but air below.

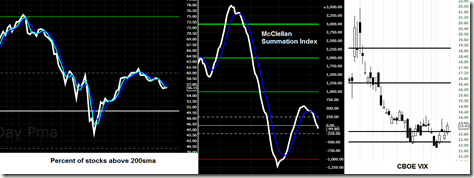

Market Internals:

Internals really aren’t looking too hot and VIX is looking ready to take off. If there was real strength in this market during this last run, both McClellan Summation and Percent of Stocks Above 200 would be a lot higher than they are now. On top of that at the slightest bit of selling they are both turned down ready to tank. If the selling gets going, those two internals will be below the midpoint in no time. If they stay below the midpoint, especially if the market starts rallying again, then there will be a serious problem on my end.

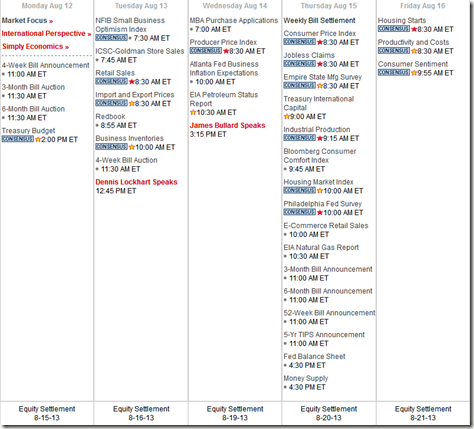

Economic Releases:

Decent amount of news this week to keep the markets busy aside from Monday. Inflation numbers, retail sales, and housing numbers should get Wall Street excited. Remember, good news is bad news and bad news is good news.

Take it easy and happy trading to everyone,

-Michael