Stock Index Futures:

I mentioned last week to be on the lookout for distribution on the daily charts because of the symmetry the weekly charts were showing. However, this time when distribution was spotted we got accumulation bars twice as big as the distribution. Also printed a buy signal on the weekly charts, though I am not a fan of buying highs. For day trading purposes breaking above the distribution could be a good trade. Still though, every time the slow trigger has gotten around 25 this market has needed some type of pause. We are now at 28 printing distribution, it is only natural to have people rushing to buy at any sign of pullback giving accumulation bars but it really is time to have a pause. Also a buy signal was printed on the Russell daily charts, but again very extended at the highs. Though they may work short term, when I am taking signals off of daily and weekly chart I am looking to hold them for a while. This market isn't looking back, especially the Russell. I don’t think a significant correction will come until we close below the monthly fast avgs. So I prefer to wait on a nice size pullback similar to what we have got twice before, take positions in both indices and stock, and let the QE do its job.

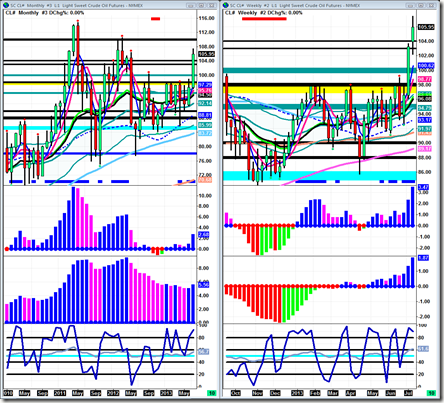

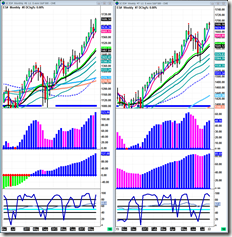

Crude Oil:

We got the pullback that was much needed in crude oil. Also got buy signals on weekly and daily. I see no reason why it wont get bought. All the retail traders are looking for $100, big red weekly bar confirming to them their bearish outlook, monthly and weekly charts in a solid uptrend.. they might get their heads ripped off. $103 will be an important level if the buyers don’t start buying immediately into Monday. To be more conservative would be to wait until price gets back above fast avgs on the daily. Still though I like this setup above the weekly fast avgs. If it works as it should, $110 could be the new support instead of $103-104. That is about all I have to say, you already know everything else I think of crude.

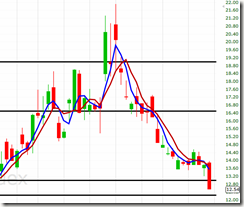

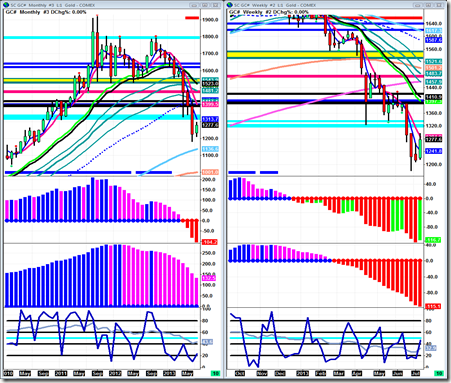

Gold:

Well, the buy signal from last week really worked out. Even though a distribution bar was printed on the weekly, I am still expecting a test of the immediate backup (20ema). That would also be a buy signal above the high of the distribution printed last week. Daily chart still looks bullish and is also showing the possibility of testing 1390-1400. That would also be the fast avg on the monthly chart. So three time frames saying 1390-1400 is very possible. Now, from there high probability it will be sold but we arent there yet. In fact, this week is a sell signal below the lows and a buy signal above the highs. Obviously I like the buy side because there is nothing but air on all time frames up to near 1400. Sell side there is a bunch of junk in the way, so I wouldn’t take that. But this is a good time to see if the buyers are buying or the sellers are selling in the big picture.

However, I said a while ago that it will take a few months to bottom and the only way that can be avoided is with an extremely strong V spike on the monthly reversal. If that happens, then you really better fasten your seatbelt because $5000 will be here before you know it. Other than a V spike reversal, it will take a few months to bottom just as Apple has done. I said the same thing about Apple too, I said it would need a 6 month minimum bottom base. Also for a V spike reversal here on gold, the August bar is seriously going to have to be a massive green bar engulfing candles back up to 1500.

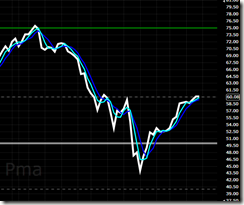

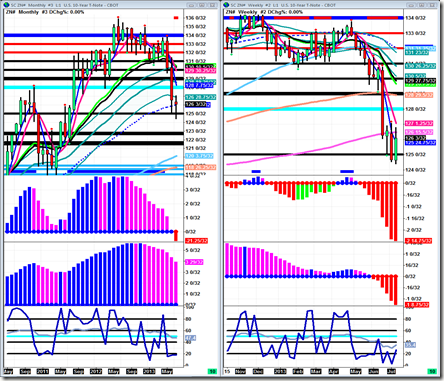

Treasuries:

Notes are still looking like trash and until we can break the highs of this past week and the week before, they will continue to look like trash. This is because the buyers aren’t buying. When I see buy signals that aren’t being bought that tells me something. Now we also have a sell signal to watch as well below this past weeks low. Similar to gold, this is a good time to see who is doing what. Are the buyers going to push price above 127 10/32 or are sellers going to take it below this past weeks low. That tells me if the buyers are buying or the sellers are selling in the big picture and that is important to both day and swing trading. For the record, sell side is preferred here below last weeks low because there is nothing but air.

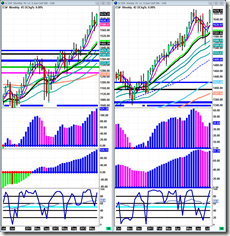

Market Internals:

Percent of stocks above 200sma is the best read of the market in my opinion. It is in the beginning stages of rolling over and still need to see more before coming to any conclusions. I have made myself very clear about what I think of % stocks and summation index below 50% and 0 lines. This is building a top territory if they can get below and stay below. During the housing bubble, both of these indicators were below 50% and 0 line as stocks were making new all time highs. So it is important to watch these. They also show underlying strength of the market. If this market was as strong as it looks why wouldn’t 75 or 85% of stocks be above 200 day moving average instead of 50 or 60%? Why would advancing to declining issues be near 2500 instead of 500? I suppose things are still bullish so long as they stay above 50% and 0. But these are things to watch, both the direction of these indicators and the levels at which they are at.

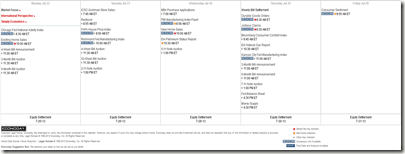

News Releases:

Looks to me like a good week of trading is coming. We have lots and lots of data being released, and two MAJOR ones being FOMC meeting announcement and Employment situation. Lately with FOMC, it will cause a stagnant market all day then a knee jerk reaction when it comes out then the market tries to fit in a days worth of trading into the last two hours. It does this by either having huge swings or a fast trend. Although this time we have a few important releases before FOMC so it may just be a jam packed Wednesday. Employment situation just has a massive spike in most markets the second it comes out and tends to give good trading the rest of the day. ISM Manufacturing also gives great trading, no specific type though. I mean wow, I really just took a good look at this weeks news and there is a ton of important releases back to back. So get ready.Also, I meant to have my next education piece out on the key support and resistance levels but I have been pretty busy. I will get it out when I can sometime soon.

Take it easy and happy trading everyone,

-Michael