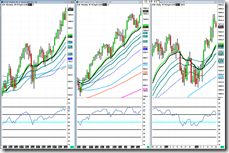

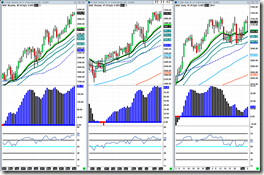

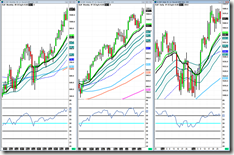

Stock Index Futures:

This week is proving to myself that I am not crazy. The weekly S&P chart looks like trash, as well as the Dow. The week before last, we printed a distribution bar (a very strong one at that). I am sure I talked about it in last week’s recap. This week gave us confirmation that people are in fact selling at these levels, which is what I have been saying since the failure pattern in early August. The debt ceiling thing is obviously going to have some impact, but even if they do get it together and pass something to kick the can down the road, I don’t think the market is going to care. We are so technically damaged here while being very extended from this artificial run while everyone in the world is waiting on a pullback to buy, there is no reason we shouldn’t get one. The weekly divergence still has not failed which is just another sign sellers are doing the deed up here. We now, as of last week, have a confirmed failure pattern on the weekly chart. Russell chart does not look so terrible, aside from the fact that all of last week was printing distribution bars at $1080. The 4 bar weekly runs the Russell has been having all year ended in a doji this time around, showing weakness. There is also some divergence on the daily and weekly chart that the sellers could take advantage of. Below Friday’s low on the Russell will trigger lower prices. I do not expect the 20ema on weekly chart to hold again, it has held three times already, and it is just too damn obvious this time. But, I will be watching it as a short term target. That would be $1020 on Russell and $1650 on S&P. If those targets are hit this week I will update new ones on stock twits. The Russell does have support coming up under it, so that may act as a short term backbone depending on how hard the sellers come in. I will admit I am wrong on a weekly close at new highs on the S&P, but I seriously do not see that happening. Summary: distribution, divergence, failure pattern, extended, buyers need better prices, & bearish reactions on rally attempts. Targeting: $1020 Russell & $1650 S&P.

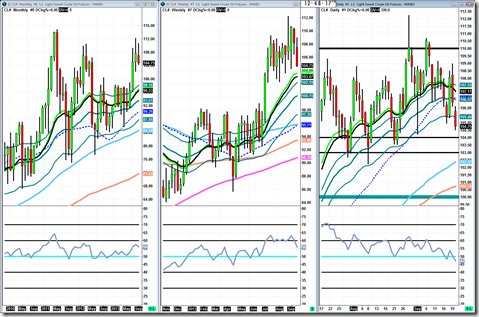

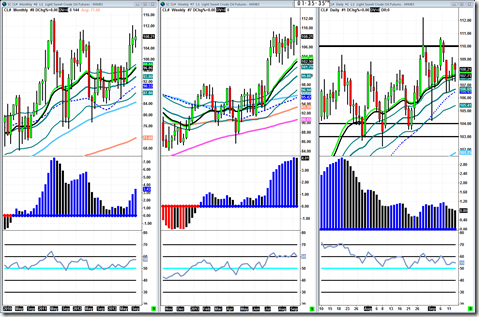

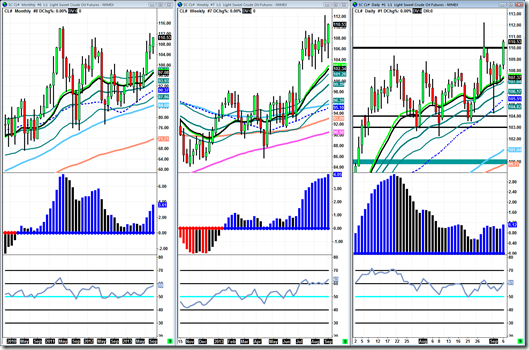

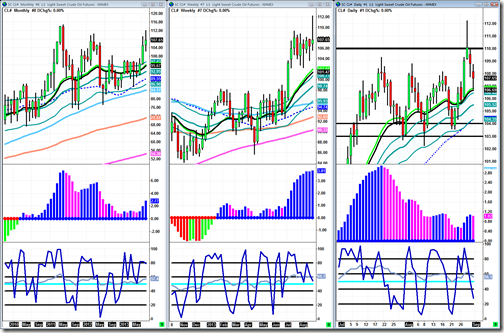

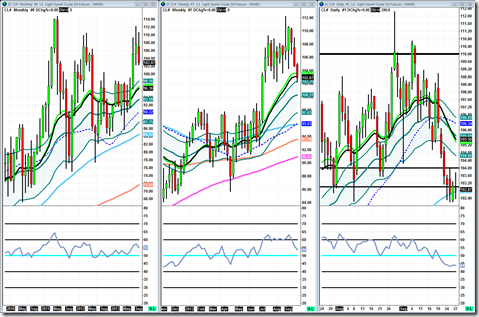

Crude Oil:

Crude made it to the first trend support target I had laid out. Buyers aren’t exactly giving the reaction I was looking for but sellers aren’t pounding through it either. That is why I have given it the threshold of getting back above $104. If it can’t do that it may need to pull lower to the $101 trend support and see what kind of reactions we get from there. This level we are at now is a good demand level if buyers could pull this off it could see a fast move back to $108. The monthly chart is not exactly what I want to see, distribution at resistance, but sometimes you have to drill down to lower time frames to see inside of that distribution so you can determine if there is bearish price structure as well. It’s not. This is a shakeout pattern that I see all the time and it typically leads to V shape reversals, which is why I gave it the $104 threshold to break above. So that is where we are at on crude, still waiting for a reaction.

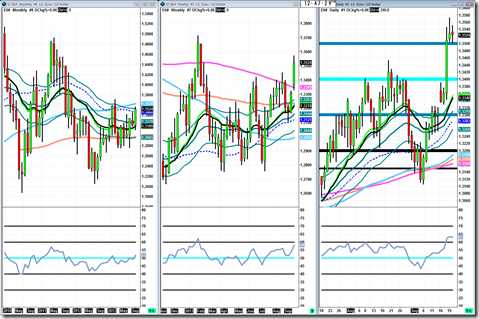

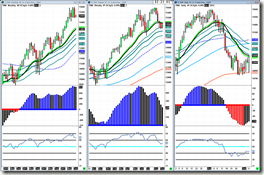

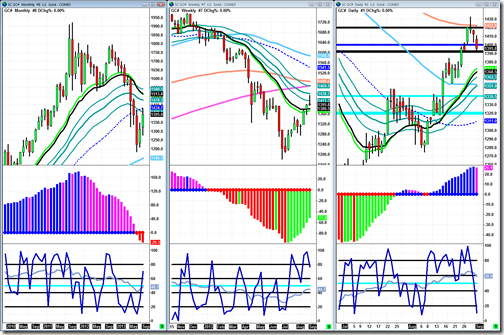

Gold:

Gold never did get that breakdown below $1320. It didn’t overcome any major resistance levels either. If bulls are really going to take charge here, they will reclaim $1350 and show some conviction. I do see some resistance and congestion at $1370 both on a weekly and daily chart, so there is another problem for bulls. If they can’t do that, then I will still be waiting on huge bearish moves below $1320 (or $1310 if you want to be more sure). Fairly straight forward plan. Gold has been very unwilling to play ball on an intraday basis and this is likely why. Bulls and bears are duking it out for territory and there will be big moves once one of them wins. This is why you really need to pay attention to big picture and know where you are day trading at. Are you trading in a territorial fight or are you trading in an open range where massive moves can take place?

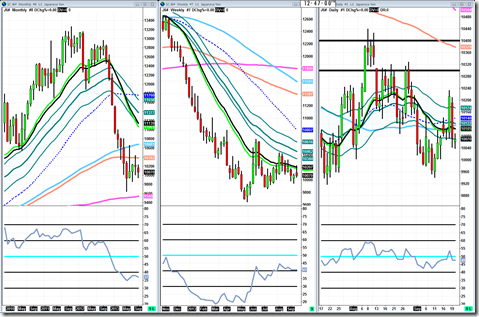

Market Internals:

Internals are pretty much confirming my analysis of what price is telling me. Remember a couple of weeks ago I said that the July/Aug high made on the Percent of stocks above 200sma indicator (shown in picture) needed to be taken out with solid price action on the indices for a healthy market to continue. Well it never happened, not even close. It is about to cross back below the half way mark, 50%. Same goes for McClellan Summation Index, it is still below the zero line which is even more dangerous for price. VIX got a huge pop on Friday but yet I didn’t see a huge sell off. People are worried about the shutdown obviously, a lot are convinced it is going to happen. I don’t know, but I know how to read price and measure correlations with market internals.

Economic Releases:

The highlight of the week is obviously Employment Situation (non farm payrolls) on Friday. But, people are going to be heavily focused on the possible shutdown or if it happens the current shutdown. So those are the two things to pay attention to during this week. ISM Manufacturing is also important on Tuesday.

Trade well,

-Michael