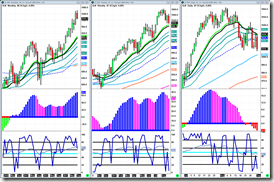

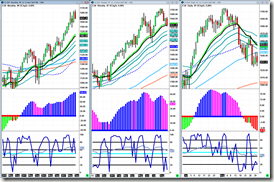

Stock Index Futures:

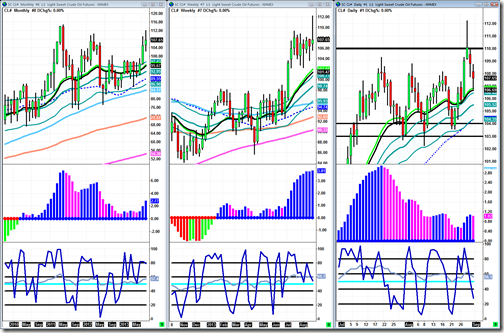

Crude Oil:

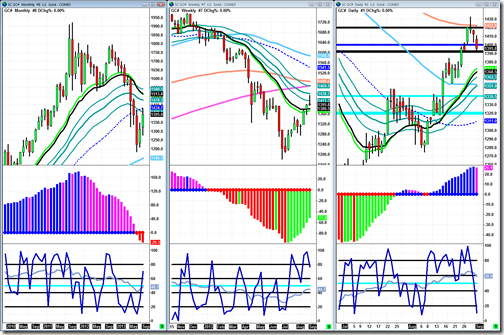

Gold:

Like I said last week, I expected $1420 to be major resistance after that huge run off of the lows. Similar to crude we got distribution on daily and weekly charts but the difference is gold is in an intermediate term downtrend. So if it breaks under $1392 support level, I will be watching the daily 20ema which is at $1370 right now. Looking at the weekly chart, that sharp V like reversal is very bullish so there is no reason to loose faith yet especially with the monthly chart still in a long term uptrend. Whatever happens, in the near future $1320 will be absolutely key to hold if gold wants anymore upside even $1340 would be better. An extremely bullish scenario would be consolidating up here near these highs, and that could act as a launch pad to $1475 and above. For now, you could really just look at the daily chart at all the support levels I am watching for reactions off of to gauge how much strength is in this market.

Market Internals:

Ok, so lets forget for a second about the levels they are actually at right now. Just take a look at where they are headed. There isn’t technical analysis needed here, they are either going up or down. Now, you see they are going down. Next what I do with these is look at the level at which they are trading at. Percent of stocks is trading at 45% of stocks above the 200sma, these are all NYSE stocks as well not just S&P like most people like to look at. McClellan is trading at –2000 which obviously isn’t bullish. Also VIX is rising.

Economic Releases:

Markets don’t open until Tuesday due to Labor day. After that the highlight of the week is definitely the Employment Situation on Friday. There are some good events before that though that should keep the market moving on this shortened week.

Take it easy and happy trading to everyone,

-Michael