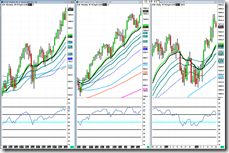

Well, it looks like the fed gave sellers a better price than they were expecting. There are going to be people blindly buying this market up until they loose money doing it. Monday we got a distribution bar right where I expected it, inside the liquidation zone. Then FOMC day, as everyone knows, shot price into new all time highs as Bernanke “surprisingly” didn’t taper QE. As of right now that is looking like sellers took advantage of that new high to unload as much of their positions as they could. It also created an upthrust bar on the weekly chart, with extremely noticeable divergences. I didn't post it here, but go look at the Dow Jones Average and throw a 21 period RSI on there. The Russell held up better than the majors, but it has tended to do that all year. I am really just waiting for the sellers to start tripping over each other as they realize the S&P, Dow Jones hasn’t gone anywhere since May and that they will likely be able to get better prices lower. I do think though that this market will likely start to get more volatile from here on out, Sept FOMC out of the way, it is clear sailing from here on out. Only the free market and QE. On the weekly I will be watching for a high close into the distribution if they are going to prove me wrong; or getting and staying under the liquidation zone (Aug highs) to prove me right. The probabilities say I am right, the market couldn’t even last two days at new highs and I have been talking about this entire zone up here as liquidation until people can get better prices.

Well, it looks like the fed gave sellers a better price than they were expecting. There are going to be people blindly buying this market up until they loose money doing it. Monday we got a distribution bar right where I expected it, inside the liquidation zone. Then FOMC day, as everyone knows, shot price into new all time highs as Bernanke “surprisingly” didn’t taper QE. As of right now that is looking like sellers took advantage of that new high to unload as much of their positions as they could. It also created an upthrust bar on the weekly chart, with extremely noticeable divergences. I didn't post it here, but go look at the Dow Jones Average and throw a 21 period RSI on there. The Russell held up better than the majors, but it has tended to do that all year. I am really just waiting for the sellers to start tripping over each other as they realize the S&P, Dow Jones hasn’t gone anywhere since May and that they will likely be able to get better prices lower. I do think though that this market will likely start to get more volatile from here on out, Sept FOMC out of the way, it is clear sailing from here on out. Only the free market and QE. On the weekly I will be watching for a high close into the distribution if they are going to prove me wrong; or getting and staying under the liquidation zone (Aug highs) to prove me right. The probabilities say I am right, the market couldn’t even last two days at new highs and I have been talking about this entire zone up here as liquidation until people can get better prices.Crude Oil:

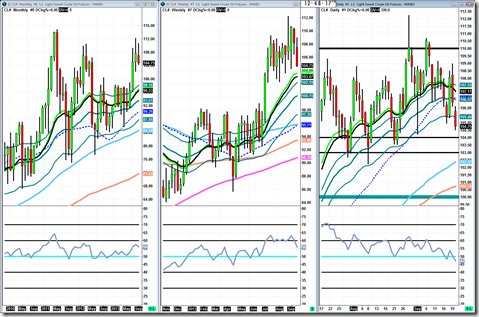

Wild ride in crude this week. It did not hold last week’s lows and that means I am still looking for $103-$104 support. Now after re-assessing the current price structure, I think it is very possible we break the $103-$104 support and go to test the long term trend support at $102.5-$100.75. The good news for the bulls is if they (buyers) are still active and just waiting for better prices; this is the kind of price structure that could create a V shape bounce and launch it into new highs. Anyway, you know the drill. Watch for what kind of reaction we get off of $103-$104 support and if it isn’t good, anticipate the long term trend support to come in play. Remember the big picture as well, the trend is up long term. It just needs to back and fill that massive move in July, as well as take out the weak hands.

Wild ride in crude this week. It did not hold last week’s lows and that means I am still looking for $103-$104 support. Now after re-assessing the current price structure, I think it is very possible we break the $103-$104 support and go to test the long term trend support at $102.5-$100.75. The good news for the bulls is if they (buyers) are still active and just waiting for better prices; this is the kind of price structure that could create a V shape bounce and launch it into new highs. Anyway, you know the drill. Watch for what kind of reaction we get off of $103-$104 support and if it isn’t good, anticipate the long term trend support to come in play. Remember the big picture as well, the trend is up long term. It just needs to back and fill that massive move in July, as well as take out the weak hands.Gold:

Gold really isn’t looking too hot. After that massive rally on FOMC news, I posted the mid-week update for my key markets and said I really don’t like the price structure here. I said that because I know where we are on the weekly and monthly chart, which is bearish territory inside of a long term uptrend. Even on the daily chart we are in a downtrend. If gold was really that strong, trying to make a major comeback in the face of a clear downtrend; it would have held the 20ema on the daily as it broke through all the resistance across the time frames. It didn’t, it failed. Sellers grabbed it by the throat at the $1420/long term trend support resistance zone and smashed it back down. It also was getting absolutely no bullish reactions from any of the support levels on the daily, and in the face of the weekly/monthly positioning; that counted me out of the bullish camp. You can tell people that were long from the $1400 level just wanted out and to run far away from gold. That blue dotted line is a channel low from connecting 06-28 & 08-07 lows, and once it broke down from it; I just didn’t see it getting back above as price rarely does after that kind of break. This week I will be watching the $1320 and last weeks lows as breakdown levels. I am really not much interested in the upside at this point, price would really have to pop some fireworks for me to get interested to the upside.

Euro Currency:

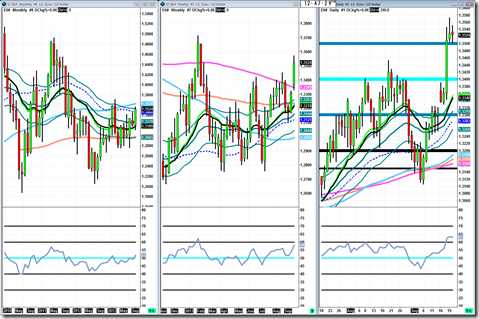

Quick note on the Euro. I included Euro in a blog post from a while back saying that I am now long term bullish, which I still am. I posted on stock twits at the beginning of September to seriously consider the possibility of a V shape bounce off of the 1.3150 level. Anyway, the fact that I am right just means that the bulls are doing what they are supposed to do; which gives me more conviction in my long term bullishness on the Euro. Just like what crude did. Over the next few years I think 1.50 is possible, maybe sooner. In the short term, the next level I am watching is 1.37. The reaction off of that will be important, I want to see it make a run to the 1.40 area which is the level after that. That may even give us the volatility we used to see in the Euro at those levels. At a minimum we need to hold 1.34-1.345 for this bull run to continue, so that is what I will be watching.

Quick note on the Euro. I included Euro in a blog post from a while back saying that I am now long term bullish, which I still am. I posted on stock twits at the beginning of September to seriously consider the possibility of a V shape bounce off of the 1.3150 level. Anyway, the fact that I am right just means that the bulls are doing what they are supposed to do; which gives me more conviction in my long term bullishness on the Euro. Just like what crude did. Over the next few years I think 1.50 is possible, maybe sooner. In the short term, the next level I am watching is 1.37. The reaction off of that will be important, I want to see it make a run to the 1.40 area which is the level after that. That may even give us the volatility we used to see in the Euro at those levels. At a minimum we need to hold 1.34-1.345 for this bull run to continue, so that is what I will be watching.Japanese Yen:

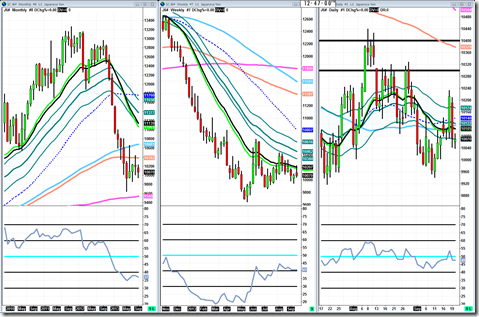

Yen looks very vulnerable to some serious selling here. The low of the week of 09-09 is the trigger in my opinion to a big move down. That specific level is 9939. Longer term charts are definitely showing bearish reactions are still in play big time, so be prepared. 9550 is the target zone for this move lower. That is about it for the yen.

Yen looks very vulnerable to some serious selling here. The low of the week of 09-09 is the trigger in my opinion to a big move down. That specific level is 9939. Longer term charts are definitely showing bearish reactions are still in play big time, so be prepared. 9550 is the target zone for this move lower. That is about it for the yen.Treasuries:

To be honest, I don’t know if this chart is completely accurate. My charting package should fix it though, but for now I only wanted to say one thing. 125 is key to hold for the bulls. If they can hold that, they can see higher prices. 127 is a resistance zone based on the weekly chart. If sellers grab hold here, it could get nasty.

To be honest, I don’t know if this chart is completely accurate. My charting package should fix it though, but for now I only wanted to say one thing. 125 is key to hold for the bulls. If they can hold that, they can see higher prices. 127 is a resistance zone based on the weekly chart. If sellers grab hold here, it could get nasty.Market Internals:

As long as those highs shown are not taken out, I consider this bearish. This is just the icing on the cake for all of the bearish analysis on the indices. I really think a correction is nearing and sparks are going to fly. These internals are bearish, make no mistake about it.

Economic Releases:

Looks like the highlight is Wednesday, Durable Goods and New Home Sales. I don’t think news will play a huge role though anymore now that the fed has admitted they aren’t going to ever taper. I think the market will continue to digest all the news it has taken in and price discovery will begin aka volatility.

Take it easy and happy trading to everyone,

-Michael