So lets get this out of the way first.. Lately I have been finding myself stripping off all my indicators really unintentionally (especially when I am looking through stocks) and eyeballing everything I need to as well as using other methods like supply/demand zones and trend lines. Price structure and location is where my focus is at for daily/weekly charts and I can see a lot better with a stripped down version of the trend setup so that’s what I’m doing. I am using the 50 & 200 SMA for determining location and part of the directional analysis. I definitely still recommend the trend support though if you are still learning trends, no doubt about it. This is just what my instinct is telling me to do, so lets get into the recap..

Envision The QE

Many well respected people continuously criticize the people calling this market a bubble. I should only need to ask one question: Would this market be trading at this level if we had no QE? If the answer is no, then you agree that mal-investment is being made into equities therefore causing a mispricing of the stock market. The main argument is that there isn’t anything happening as huge as the housing market or the tech boom. Take a look at the Federal Reserve balance sheet, our deficit/trade deficit, unfunded liabilities plus the national debt, or the debt:GDP ratio.

Stocks To Watch

I run scans looking for stocks every so often and this time I figured I would share the list I made with all of you. Note that just because they are on this list doesn’t mean I am going to buy on the market as soon as Monday opens. Some of these still need to trigger entries, some are building bases, & others are ready to go but you will have to make that decision on your own for when you like to enter. Long only names with good fundamentals so they can be trusted for months at a time. Click the images for live charts or hover to see the ticker symbol:

Looking Inside…

After these two down days ensuing after a fairly strong three day rally, people may be looking for reasons to take profits. Here are two things to think about (click the images for live charts):

11-17-13 Weekly Recap & Outlook

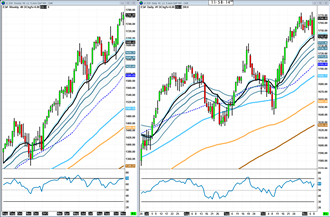

Stock Index Futures:

I suppose it was inevitable after we got the range expansion in late October. I talked last week about breaking out of $1775 as a threshold to see new highs and sure enough we got it. I also said if that happened then something has changed in the markets because we didn’t get a real pullback before getting liftoff again. Now people are just buying the 20ema on the daily chart rather than the weekly, so we have kicked it up a notch. The range expansion may have kicked off a fairly large rally, so there really isn’t much else to say here except don’t dig in your heels. Embrace the rally, use stops, watch the 20ema on the daily as well as the RSI on the daily and weekly. As per you volatility lovers like myself, at least we aren’t covering miniscule ranges like we were in January/February, so who cares if we go up or down?

I would like to address (rant about) this bubble fiasco as well. I am in the camp that we are in a full blown bubble at this point. Why? Because ask yourself if the market would be at these levels if the fed weren’t in the market. If the answer is no (as mine is) then you agree that this asset class is in a bubble and that we are not in a real recovery but a recovery being propped up by the fed; a ‘recovery’ that can’t survive without the fed. If you want to lie to yourself and pretend like America is in some kind of ‘economic boom’ and live in the fantasy land with the rest of an Keynesians well then that is your decision to make. I don’t want to hear a list of 25 statistics proving that we are in some kind of economic boom because all I have to do is look at the middle class then look at Wall Street and the transfer of wealth is absolutely obvious. A transfer of wealth does not constitute economic boom, walling yourself into the corporate side of America and shouting “economic recovery!” does not constitute a recovery, telling me about how ‘strong’ our financial sector is because we have 0% interest rates, and how much debt Americans are going into so they can consume now does not create prosperity in the long term. My explanation for this market charging full speed ahead is the cheap money being provided to Wall Street for speculating, along with interest rates forcing people into equities, and the propaganda campaign by the media that our economy is in some kind of wonderful period in American history. Everything else you hear about is just people trying to justify why they are bidding this market up, it makes them feel a lot better about it.

Now that I said that, I should say this too. Don’t trade based on that. Trade based on what you see (on your charts) the majority of the market doing. If you see a bubble being built up and up and up then trade to the long side. Buy equities, join the party. There is no nobility in sitting out on a fortune, but don’t justify you doing it because of economic growth, because we all know that is a fallacy. Just be real and say you are doing it because there is a lot of momentum in this fed driven equity market. There is also no nobility in trading the wrong side of the trade, all you are doing is making yourself look like a fool while at the same time taking huge losses while everyone else is getting rich. If you truly believe that we are in a bubble as I do then just watch out for a long term top, meaning a top on the weekly charts. In the mean time, trade your plan and manage your risk.

Crude Oil:

Crude still really isn’t looking very good to me. Even if it gets above $95 there is a ton of trend support coming down on top of it. The weekly chart is showing some slight accumulation off of the trend support, but still the daily chart has a lot of work to do. $93 will be an important are for next week to break for more downside. Next key levels are the 3 at; $92, $90, & $88 so its possible we go mingle with those guys but at the same time the last trend support on the weekly is right below $92 so keep that in mind as well. We are at kind of a decision point in crude right now so I will just be waiting to see what road it takes.

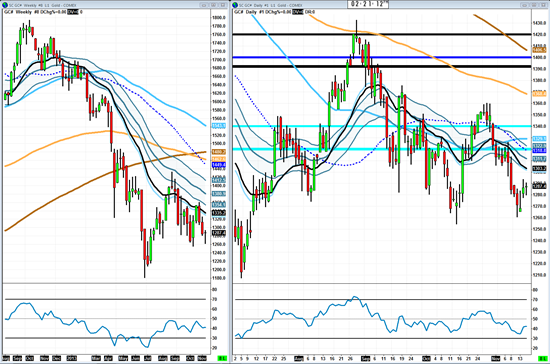

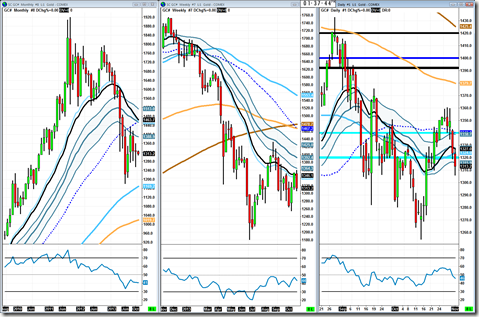

Gold:

I still hold to my thresholds that below $1320 is bearish and below $1280 is very bearish. It can’t seem to hold below $1280 for any period of time though. Weekly chart trend support still coming down like a ton of bricks and RSI still bearish on both time frames. I suppose we should be watching the swing low put in at $1260 now twice to break for more downside as well as watching the 20ema on the daily to get some bearish reaction as a confirmation of more downside to come. The structure on the weekly chart is also really bearish, so downside is much more probable in my opinion.

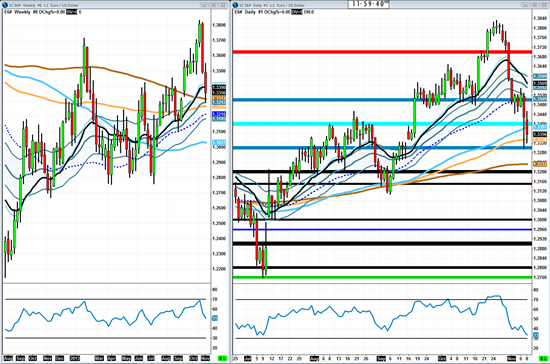

Euro Currency:

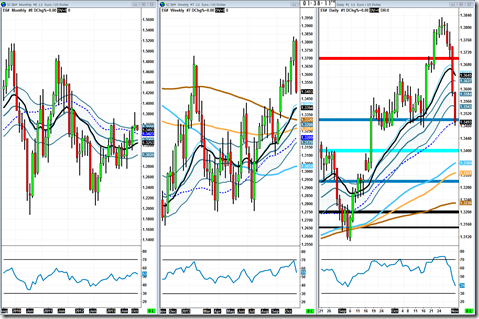

Euro getting some slight bullish reactions off of the daily and weekly trend supports. Will be watching 1.3500 for a break and hold above, that would be refreshing for bulls to see. Just the fact that it is getting some decent reactions across time frames should put some puff back in the bulls chest. That was a pretty steep drop though, so I wouldn’t be surprised to see some consolidation before heading higher, if it is going to head higher. I am not really interest in any downside action if it comes to that. Looking at the dollar index it should be clear why 1.3800 failed on the Euro; because that 79.000 band on the dollar is quite the strong one and if it gets below that there could be a very quick move down to 76.000. No trend support is in the way of the dollar either, in fact trend is pointing lower across time frames, especially the monthly.

Market Internals:

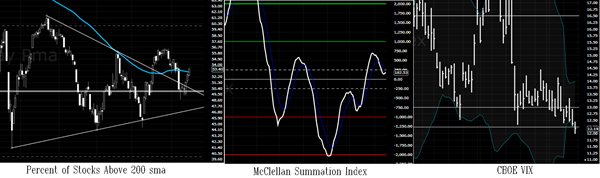

Well stocks are holding things together on the internals. Percent above 200 is working its way back above the blue line, McClellan is turning back up and VIX is completely dead I mean no movement at all. Bollinger bands are squeezing on the VIX as well which historically has led to a pop in the VIX (as well as closing below the lower BB) but that was in a different market condition (before the range expansion kicked off a different kind of rally). Also every time we have approached this 12.25 level, some buy pressure comes into the VIX. Anyway, we will just have to see how this one plays out. I would consider the VIX most important to watch here being it has three signs that it should head higher, so lets see how it reacts to that.

Economic Releases:

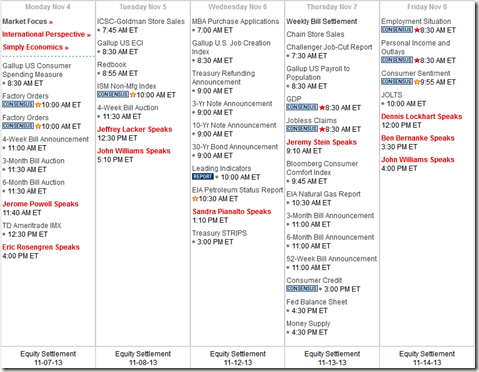

Highlight of the week going to FOMC minutes on Wednesday. Other than that, CPI and PPI will be important numbers (for the Fed at least, I don’t believe in them). Retail sales, home sales, philli fed survey, business inventories, PMI, housing market index are all important stuff. We have a packed board this week so it should be a good one.

Trade well,

-Michael

We May Be in a Bubble, but Not Quite Parabolic Yet

I ran across something today which is quite compelling information on where our market is going and what it is currently doing. This of course in context with the current market psychology & QE programs. You can argue that we are in a bubble, but after seeing this you will see that we aren’t completely parabolic yet.

Trade2day1

Nov. 13 at 1:25 PM

is it just me or are the corrections getting smaller and smaller? #euphoria $TF_F $ES_F $SPY http://stks.co/asDL

11-10-13 Weekly Recap & Outlook

Stock Index Futures:

The thresholds that need to be given here should be quite easy to point out. On the Russell we are looking for $1110 to break higher and hold if price is looking to make new highs. For the S&P, the threshold is breaking and holding above that distribution ($1775) into new highs. If that does happen then something has changed, we never got the weekly test of the 20ema. It is definitely possible to smash into weekly overbought territory for a while. The flip side to upside thresholds is breaking and holding below $1740 on the S&P and $1075 on the Russell. You can’t deny those weekly candles are bullish though. I just want volatility back, so I am hoping that the distribution bars will hold and we can get a nice sell off. But if that doesn’t happen I am not going to dig in my heels just because I would prefer the market to go that way.

Crude Oil:

Crude oil is really not looking too hot right now. That $95 key level is acting as good resistance and if it cant get back through it, the next level is $92. If it can get through $95, I would be looking for a test of the daily 20ema and/or $97.5 key level. Weekly chart printed a bit of accumulation on the support level, but I am not sure that is enough. I will need to see more confirmation of buyers stepping in before I start looking for real bullishness on the daily chart. Keep in mind though, the weekly and monthly chart trends are still very much in tact for now. That means nothing without the daily chart confirmation bullish activity though, just something to keep in the back of your mind.

Gold:

Gold couldn’t get back above the $1320 key level and is now about $5 from breaking down below $1280 and that really could trigger some serious selling since this is the second time we have been in this scenario. The first time just turned out to be a stop run, and now that all the retail traders are scared to take this setup a second time, this is likely the one that works and works well. $1280 is still a level that should be given great importance though. I should probably add it as a key level, but I will have to check data going way back before I do that. Anyway, look at that weekly chart as well. The sellers are just overpowering any chance that bulls have at recovering. RSI is staying below 50 and the 20ema/channel support is really suppressing this market nicely. So watching $1280 for a breakdown would be a good idea I think.

Gold couldn’t get back above the $1320 key level and is now about $5 from breaking down below $1280 and that really could trigger some serious selling since this is the second time we have been in this scenario. The first time just turned out to be a stop run, and now that all the retail traders are scared to take this setup a second time, this is likely the one that works and works well. $1280 is still a level that should be given great importance though. I should probably add it as a key level, but I will have to check data going way back before I do that. Anyway, look at that weekly chart as well. The sellers are just overpowering any chance that bulls have at recovering. RSI is staying below 50 and the 20ema/channel support is really suppressing this market nicely. So watching $1280 for a breakdown would be a good idea I think.Euro Currency:

Well, another brutal week for the Euro due to a surprise rate cut or something. As of right now there is really no upside threshold that I think is reasonable to happen next week. What I will be watching is if the Euro can hold its long term trend support because if it can it still has a chance at resuming the uptrend. It could be a very long lasting one too if it could get the momentum going behind it. We haven’t been this oversold on the RSI since March; that is not a reason to buy, just something to pay attention to. The RSI usually doesn’t get this low on the Euro, at least since it has been a dead instrument. So, there is really no trade setup but I will just be monitoring how well it holds up against the long term trend support & watching for more accumulation at these levels.

Well, another brutal week for the Euro due to a surprise rate cut or something. As of right now there is really no upside threshold that I think is reasonable to happen next week. What I will be watching is if the Euro can hold its long term trend support because if it can it still has a chance at resuming the uptrend. It could be a very long lasting one too if it could get the momentum going behind it. We haven’t been this oversold on the RSI since March; that is not a reason to buy, just something to pay attention to. The RSI usually doesn’t get this low on the Euro, at least since it has been a dead instrument. So, there is really no trade setup but I will just be monitoring how well it holds up against the long term trend support & watching for more accumulation at these levels.Market Internals:

The VIX almost woke out of her coma this week, but the bulls kicked her in the face. Percent of stocks above 200sma and McClellan Summation Index are both turning lower. There is a lower wick on the percent above 200 at the 50% level, but the bull trap scenario I laid out on that indicator a while back is coming to fruition. If it breaks lower, we could really have a bear party and bring some volatility back into this market and there is nothing I want for Christmas more than that. As far as this week goes, I will be watching for the percent above 200 to stay below that blue moving average (89 period) so the bull trap will stay alive and well.

The VIX almost woke out of her coma this week, but the bulls kicked her in the face. Percent of stocks above 200sma and McClellan Summation Index are both turning lower. There is a lower wick on the percent above 200 at the 50% level, but the bull trap scenario I laid out on that indicator a while back is coming to fruition. If it breaks lower, we could really have a bear party and bring some volatility back into this market and there is nothing I want for Christmas more than that. As far as this week goes, I will be watching for the percent above 200 to stay below that blue moving average (89 period) so the bull trap will stay alive and well. Economic Releases:

Not much going on with the news release side of things this week. I guess we get to see how negative our trade deficit is, how terrible our treasury budget is looking, and how terrible industrial production continues to be, but those are things we already know. Looks like EIA Petroleum Report was moved to Thursday. I wonder what the market will decide it wants to trade on this week, QE perhaps?

Not much going on with the news release side of things this week. I guess we get to see how negative our trade deficit is, how terrible our treasury budget is looking, and how terrible industrial production continues to be, but those are things we already know. Looks like EIA Petroleum Report was moved to Thursday. I wonder what the market will decide it wants to trade on this week, QE perhaps? In case you missed it, I did put out the education piece on building a trade plan called Probabilities, Risk/Reward, & Trade Management. If you don’t yet have a trade plan, I highly recommend you not only read this but study it. Having a trade plan is the most important thing you could ever do in this business. I stress it because when I first started trading I was one of those that told myself, “I don’t need a damn plan, I can wing it. I’m smart enough.” Well that didn’t work out too well for me, not only that but when I actually tried to put one together I had no idea how to do it or even what I was trying to put together. Just like everything else, I had to learn it for myself what was important and what wasn’t so I am trying to give you a shortcut here. I hope it helps you.

Trade well,

-Michael

Probabilities, Risk/Reward, & Trade Management

“When we play, we must realize, before anything else, that we are out to make money.”

These three things are the most important parts of your trading whether you acknowledge it or not. This piece will trump everything I have written before this in the level of importance, even though those things are very necessary and give you more of an edge, this is an absolute necessity to building wealth and maximizing profits consciously so you can be consistent in the long term. Again, like the previous piece this is more of the art of trading or rather very personalized especially when getting into trade management but I can tell you how I do things, the basic outline of what you should be researching, and really give you a foundation of how to build your trade plan by giving you the things you should seriously put focus on. If you are really serious about this, and willing to put in the 10,000 hours the least I can do is push you in the right direction so you don’t get caught up jumping from strategy to strategy paying “educators” to teach you something that you have to learn for yourself anyway. That is what this whole education section is based on. This post is going to be a rather long one because of its importance, but those who are serious about trading and don’t have a grasp around it yet, don’t know exactly how to formulate a trade plan, or just understand that good traders never stop learning will take the time to read it. If you just map out a trade plan using the layout I am about to explain, you are already so much farther ahead of the majority than you even realize.

These three things are the most important parts of your trading whether you acknowledge it or not. This piece will trump everything I have written before this in the level of importance, even though those things are very necessary and give you more of an edge, this is an absolute necessity to building wealth and maximizing profits consciously so you can be consistent in the long term. Again, like the previous piece this is more of the art of trading or rather very personalized especially when getting into trade management but I can tell you how I do things, the basic outline of what you should be researching, and really give you a foundation of how to build your trade plan by giving you the things you should seriously put focus on. If you are really serious about this, and willing to put in the 10,000 hours the least I can do is push you in the right direction so you don’t get caught up jumping from strategy to strategy paying “educators” to teach you something that you have to learn for yourself anyway. That is what this whole education section is based on. This post is going to be a rather long one because of its importance, but those who are serious about trading and don’t have a grasp around it yet, don’t know exactly how to formulate a trade plan, or just understand that good traders never stop learning will take the time to read it. If you just map out a trade plan using the layout I am about to explain, you are already so much farther ahead of the majority than you even realize.

11-03-13 Weekly Recap & Outlook

Something I wanted to say about these blogs before getting started.. I don’t consider them predictions or anything like that and I never have. I consider these laying out a scenario to see how the market reacts to that scenario. If I say there is a good chance for a rally this week and on Monday and Tuesday there is just distribution bars, well the market isn’t reacting to that scenario in a favorable way so that tells me that I either don’t want to touch it or I want to look for the opposite move. If I say I want crude to reclaim the $104 level for a nice move to the upside, but the entire week $104 (or even another key level below $104) is giving strong resistance; that tells me that sellers are not allowing that threshold to be met and they have the upper hand in the market. If I say I want to see accumulation off of the 20ema for a rally and we open up Monday and shoot straight up well that tells me bulls don’t have time for accumulating at a reasonable level they want it now and that tells me the mood or sentiment of the market is everyone is chasing and bidding this market up fast. New information comes in all the time in the market and these are just scenarios to see how the market is going to react to it.

----------------------------------------------------------------------------------------------------------------------Stock Index Futures:

The Russell very much underperformed everything else this week which should be concerning since it has been the leader this entire market rally this year. I said it should be for a reason, this market is so juiced up on QE it doesn’t know when a pullback is a good idea. As sellers come in so do buyers, and when buyers come in, more buyers come in. That has been the theme at least since May. On the Russell we have a weekly candle pattern that on the daily is coming right into support. So will need to watch the reaction off of that daily $1085 level. If we break below the next level I will be watching is the daily 50sma. S&P hasn’t even tested the 20ema on the daily chart yet so obviously that would be the first level to watch. S&P printed some distribution on the weekly and that usually has led to some kind of pullback even if it is a tiny one that just gets bought. So on a weekly basis we need to be watching the 2013 holy grail 20ema on both Russell and S&P to be tested. However, if the daily charts can hold support without weeklies going to the 20ema.. the pattern may be changing and we could see something new. Monthly bars closed and they closed very nicely, as well as Russell breaking the red-green-red-green pattern. A few tweets regarding stock indices this week #timestamped #techniques:

Crude Oil:

The first thing I see when looking at this chart is the daily slamming into a key level while being oversold on the RSI. Now, I am not in denial that crude completely fumbled any chance it had at heading higher in the short term (which is why I gave it the $104 threshold that it could never recover) and will have to build another base for that to happen. I am saying we could see a bounce back up to $97.5 if $95 holds. The weekly and monthly are also sitting right at support levels that have been holding up. I don’t know how many more support levels it is going to crash through, I do know there is no setup though unless taking the chance at buying that weekly/daily ($94/$95) support is in your playbook.

Gold:

Gold couldn’t play ball either, good thing that distribution was as clear as the sun during the day. Distribution into weekly resistance levels is not something you want to be long against. Anyway, we are back at giving gold this $1320 threshold. Below is bearish, above needs to prove itself again. I am considering that $1280 is trying to prove itself as a key level so again, $1280 will be the last level to beat before a free-fall. That weekly chart is just too powerful, every time that thing smacks down the price action. If it can recover itself I am still looking at that higher high to be taken out for a classic reversal, but it has to do it.

Euro Currency:

Yet another symbol that couldn’t play ball. I asked it kindly to hold 1.3700 and it smacked me in the face with a big huge monthly distribution bar and gave back about 400 pips. Right now it is sitting at 1.3500 support and I still give it the 1.3700 threshold to recover, if it wants to keep tanking it is heading toward 1.3400/1.3350. Long term, I am still bullish though (mainly because of dollar monthly chart) but that has no bearing on week to week price action.

Market Internals:

VIX is still completely dead, no signs of life. Percent of stocks got back above the 89sma and McClellan summation recovered that high I was watching for so long. So in order to keep the bullish theme going, VIX needs to hold right where it is, and the other two need to hold above those levels and head higher.

Economic Releases:

Highlight for the week is the Employment Situation Friday, other than that we have GDP on Thursday and nothing else is really important. Hopefully we wont chop around due to that.

A shout out to my followers –>

Trade well,

-Michael