Something I wanted to say about these blogs before getting started.. I don’t consider them predictions or anything like that and I never have. I consider these laying out a scenario to see how the market reacts to that scenario. If I say there is a good chance for a rally this week and on Monday and Tuesday there is just distribution bars, well the market isn’t reacting to that scenario in a favorable way so that tells me that I either don’t want to touch it or I want to look for the opposite move. If I say I want crude to reclaim the $104 level for a nice move to the upside, but the entire week $104 (or even another key level below $104) is giving strong resistance; that tells me that sellers are not allowing that threshold to be met and they have the upper hand in the market. If I say I want to see accumulation off of the 20ema for a rally and we open up Monday and shoot straight up well that tells me bulls don’t have time for accumulating at a reasonable level they want it now and that tells me the mood or sentiment of the market is everyone is chasing and bidding this market up fast. New information comes in all the time in the market and these are just scenarios to see how the market is going to react to it.

----------------------------------------------------------------------------------------------------------------------Stock Index Futures:

The Russell very much underperformed everything else this week which should be concerning since it has been the leader this entire market rally this year. I said it should be for a reason, this market is so juiced up on QE it doesn’t know when a pullback is a good idea. As sellers come in so do buyers, and when buyers come in, more buyers come in. That has been the theme at least since May. On the Russell we have a weekly candle pattern that on the daily is coming right into support. So will need to watch the reaction off of that daily $1085 level. If we break below the next level I will be watching is the daily 50sma. S&P hasn’t even tested the 20ema on the daily chart yet so obviously that would be the first level to watch. S&P printed some distribution on the weekly and that usually has led to some kind of pullback even if it is a tiny one that just gets bought. So on a weekly basis we need to be watching the 2013 holy grail 20ema on both Russell and S&P to be tested. However, if the daily charts can hold support without weeklies going to the 20ema.. the pattern may be changing and we could see something new. Monthly bars closed and they closed very nicely, as well as Russell breaking the red-green-red-green pattern. A few tweets regarding stock indices this week #timestamped #techniques:

Crude Oil:

The first thing I see when looking at this chart is the daily slamming into a key level while being oversold on the RSI. Now, I am not in denial that crude completely fumbled any chance it had at heading higher in the short term (which is why I gave it the $104 threshold that it could never recover) and will have to build another base for that to happen. I am saying we could see a bounce back up to $97.5 if $95 holds. The weekly and monthly are also sitting right at support levels that have been holding up. I don’t know how many more support levels it is going to crash through, I do know there is no setup though unless taking the chance at buying that weekly/daily ($94/$95) support is in your playbook.

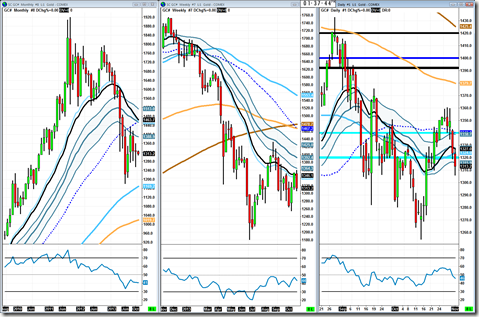

Gold:

Gold couldn’t play ball either, good thing that distribution was as clear as the sun during the day. Distribution into weekly resistance levels is not something you want to be long against. Anyway, we are back at giving gold this $1320 threshold. Below is bearish, above needs to prove itself again. I am considering that $1280 is trying to prove itself as a key level so again, $1280 will be the last level to beat before a free-fall. That weekly chart is just too powerful, every time that thing smacks down the price action. If it can recover itself I am still looking at that higher high to be taken out for a classic reversal, but it has to do it.

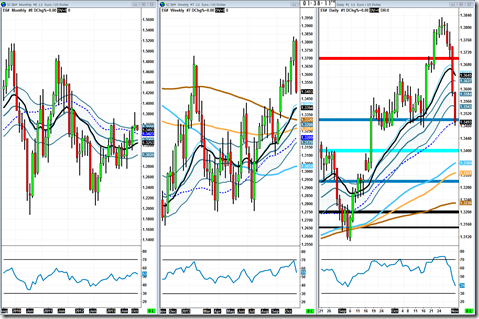

Euro Currency:

Yet another symbol that couldn’t play ball. I asked it kindly to hold 1.3700 and it smacked me in the face with a big huge monthly distribution bar and gave back about 400 pips. Right now it is sitting at 1.3500 support and I still give it the 1.3700 threshold to recover, if it wants to keep tanking it is heading toward 1.3400/1.3350. Long term, I am still bullish though (mainly because of dollar monthly chart) but that has no bearing on week to week price action.

Market Internals:

VIX is still completely dead, no signs of life. Percent of stocks got back above the 89sma and McClellan summation recovered that high I was watching for so long. So in order to keep the bullish theme going, VIX needs to hold right where it is, and the other two need to hold above those levels and head higher.

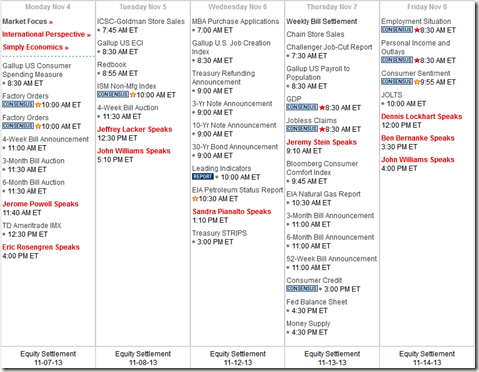

Economic Releases:

Highlight for the week is the Employment Situation Friday, other than that we have GDP on Thursday and nothing else is really important. Hopefully we wont chop around due to that.

A shout out to my followers –>

Trade well,

-Michael