Stock Index Futures:

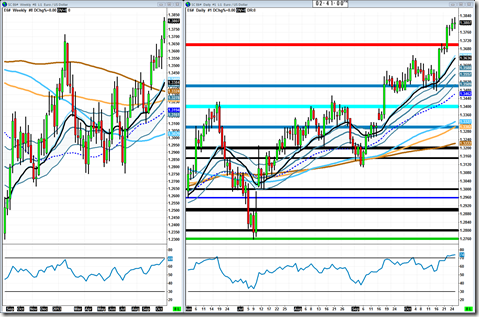

So picking up from last week, the range expansion led to a healthy consolidation pretty much over the entire week. The bullish structure was definitely kept in place, especially on the S&P and the Russell gave some very clear breakout levels at $1120. Like I said last week, I have no idea how long this one will last but all I do know is people were shorting the $1700 area and we have now left that range. Those shorts will get squeezed as long as the bulls have the juice to do so, and gauging on the price action right now they do so long as they can get liftoff straight out of this mini pattern. The only thing that concerns me is that this pattern looks exactly like the July top. It is still a bullish pattern as it stands now, but just be aware it could change into a failure like July did.

So picking up from last week, the range expansion led to a healthy consolidation pretty much over the entire week. The bullish structure was definitely kept in place, especially on the S&P and the Russell gave some very clear breakout levels at $1120. Like I said last week, I have no idea how long this one will last but all I do know is people were shorting the $1700 area and we have now left that range. Those shorts will get squeezed as long as the bulls have the juice to do so, and gauging on the price action right now they do so long as they can get liftoff straight out of this mini pattern. The only thing that concerns me is that this pattern looks exactly like the July top. It is still a bullish pattern as it stands now, but just be aware it could change into a failure like July did.Crude Oil:

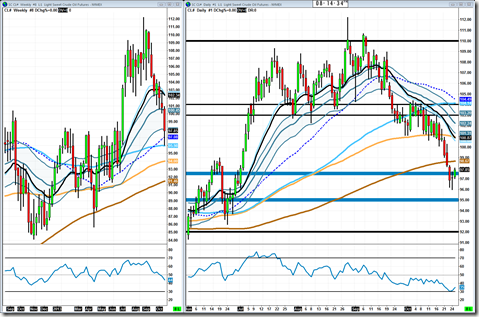

Well the breakdown target was achieved with ease last week and then gave some more. It also broke through the $97.5 key level but found daily accumulation on the weekly long term trend support at $96. So $95-$96 will be the area I will be watching for buy pressure and $97.5-$98.5 (200sma) will be two levels I’ll be watching for sell pressure or for bulls to reclaim. As far as RSI analysis goes, bulls have an oversold reading to work with on the daily while at the same time being at known support on the weekly. Keep in mind that the long term trend structure (weekly, monthly) is still place very much so, which means it is only natural for me to lean bullish but still be aware of the downside and trade it if need be. Although where we stand now, between the weekly and daily there is just support all over the place.. literally at every round number except $93.

Gold:

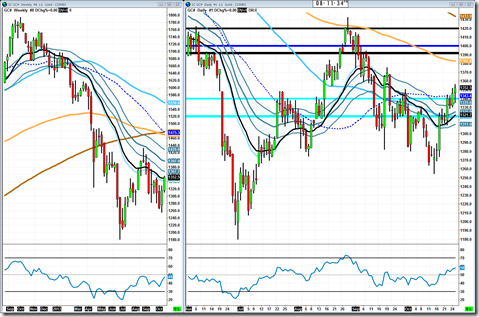

Gold has really washed up as a day trading instrument. You never know if it’s going to have a nice trend day or just chop/algo spike all day like it does 9/10 days. Algos have completely destroyed it, either that or the manipulation the suppress the price. Anyway, even though it isn’t the ideal trading instrument right now there is still a very nice swing setup here to the $1380 area trend support on the daily. I really like that setup, and plenty of room on the RSI to move. Something else to be aware of is if gold can take out the higher high (HH) on the daily, that would officially be a classic reversal taking place. It may be more clear on this weekly chart. If I was deeply long in gold down here, that would really be giving me hope/optimism right now and may even drive new buyers to step in.

Euro Currency:

Euro has really been working beautifully for me. Sometime in the history of this blog (possibly around July-August) I made it official that I was long term bullish on the Euro, and at that point I started looking for reasons to confirm that. Back in September, the V shape bounce worked perfectly. Then early this month (October) I was talking about the buy signal at 1.3500 looking really good, you can check my stocktwits stream or twitter if you don’t believe me. Anyway, buyers are really doing their job right now and they have gotten a little overheated on the RSI so if price confirms the overbought situation and starts slowing down I want to see it hold 1.3700. If it can do that we can see 1.4000 then 1.4200 and eventually 1.4500. That is a nice clean break on the weekly and it’s exactly what I was looking for. Now just waiting for a large continuation of that.

Market Internals:

Internals are definitely improving, but I just hope that VIX comes back up this week because it really killed off the good trading ranges last week. Percent above 200sma is showing broadening participation across the market so that confirms a bullish outlook for now. If that 60% level high made a while back cannot get taken out then it would just be the bull trap I was looking for before we broke out. For now though we will just go with the trend until it fails. I admit it is disappointing I was really hoping for a nice, big correction (10-20%) with expanding ranges (I mean real expansion) to trade for a new months.. I think most of the big money was too so they can have a real buying opportunity, but the date on that has been pushed back once again. No reason to fight it.

Economic Releases:

BREAKING NEWS: Fed announcement comes in and there is NO TAPERING; I repeat NO TAPERING due to the government shutdown they said, data still too weak to pull back and it likely has something to do with the holiday shopping season… That is what you are going to hear in the news media this Wednesday, so just prepare for that. Obviously the Fed announcement is the highlight for the week. It looks like we are getting some shutdown data this week, I‘m not sure but just assuming that because some of the releases already have “Report” tagged on them and that usually means it has already been released, but that is what they did during the shutdown. It is a pretty packed board this week, so should be a good one.

Still working on that education piece on execution, should definitely be a good one and very helpful in building a trade plan and deciphering a trade plan from a trade strategy.

Trade well,

-Michael