Stock Index Futures:

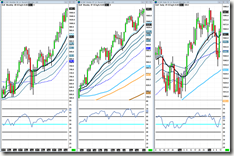

Well everything went according to plan after the Russell broke down from the level mentioned and the S&P failed to hold above $1700. So we got the sell off, and after that, to my surprise we got the biggest 2 day rally this year. Now, obviously that is a huge change of pace from the kind of rallies we have been having this year. That kind being dead, choppy, gap up days. I am thinking that this isn’t necessarily the start of a new move to the upside, but possible the start to some volatility. Of course I am biased to always crave the volatility, but I just explained the rationale. The Russell weekly 20ema was held, again, for the fourth time this year. I’m asking myself how many times is this thing going to hold. Even so, like I said last week there is sell pressure above $1080. So even if we do break above and make new highs there is a high probability sellers are waiting up there, unless we are just going to go parabolic for no reason. I won’t say it’s not possible. Bears capitulate, bulls step in hardcore, and off she goes. Anyway, $1700 will be the level I am watching as a line in the sand for bulls and bears. Above $1700, watch how bulls are composing themselves. Is there conviction or sell pressure? How is the price structure looking? That level for the Russell will be $1080. I won’t sit here and lie and act like the bulls didn’t set themselves up nicely with that weekly candle. Bears also still have a nice setup from the $1720 distribution weekly candle, so they are going to have to duke it out. Let’s all pray for a very volatile week while bulls and bears fight each other.

Crude Oil:

Crude bulls did not do well this week. As we sit right here, that is bearish price structure. The $103-$104 key levels turned into resistance as well as the 20ema and trend channel. RSI is below 50. I’m not blind to that, but I’m also not blind to that fact of marking up that $101 swing low from 9/30 and watching that as an important level for bulls to reclaim if it is broken. Weekly chart we just bounced off of the midpoint of the channel just the slightest bit, that is probably why we came so far off the lows on Friday which was something I wasn’t expecting because of the structure. I am willing to say $99-$98 is in the cards if $101 is broken and not reclaimed. Threshold to get aggressively bullish again is still $104 which was never reclaimed either. Under Friday’s lows I will be trading aggressively bearish if the right setups come along on intraday, and that’s about it.

Gold:

Like I said last week, gold was and is the easiest read out of all the instruments. Bearish is the name of the game here. Price held below $1320 which was a sign of weakness and then cracked $1280 which is a sign of watch out below. I am looking for new lows. You can say what you want about physical and fed printing or whatever and I agree with you. But I won’t put my money on that, I will bet my money on what price action tells me. What the market tells me. I mean look at that weekly chart, you cannot honestly tell me that is bullish in the slightest bit as it stands right now. The monthly too, that thing is broken. It is that simple, you have a weekly and monthly that is broken so you look for triggers on the daily, and $1280 was that trigger. Bulls would have to completely turn the tables on this to make a difference, meaning structure on monthly, weekly, and daily charts; getting past all the resistance through the time frames; turning the trend support around on the weekly and daily. Just things that don’t happen until the market is ready for them to happen. So watch for more downside, leave your emotions at the door, and trade smart. Long term (monthly chart) you can start looking for real buy pressure in the $1100-$1000 zone.

Treasuries:

I think bonds are toast. Bearish reactions on the weekly and daily charts. Weekly at 20ema and daily at trend support. I am still willing to give it to 125’0 for an official breakdown level because of my analysis on rates but still I just don’t see any conviction from the bulls on this one. Weekly chart is under all of the trend supports and getting bearish reactions from it as well as the daily. Things aren’t looking good for bonds, and that will impact the entire country and the federal government if this keeps up.

Market Internals:

Market internals are trying to make a bounce back but still aren’t even close to bullish territory. What they are trying to do is attempt to get into bullish territory. Percent above 200sma is in a big wedge pattern that I will be following, haven’t seen something like this in a while. Summation is trying to do some kind of head and shoulders thing, but I am still focusing on the fact that it is below 0. VIX fell hard this week and raising hard, hopefully that keeps up. Meaning both the rising and falling, indicating volatility and wide ranges.

Economic Releases:

I don’t know what is going to be released and what isn’t. It looks like they have already knocked out Industrial Production and the EIA reports as N/A. Assuming we get housing starts that is the highlight of the week. The real highlight though is this whole debt ceiling debacle. I love it. The ‘deadline’ is this Thursday and with the president threatening default (debt ceiling doesn’t equate to default) the volatility may be present this week.

Trade well,

-Michael