Stock Index Futures:

S&P and Russell are giving huge divergences. Russell being the stronger of the two. The month closed last week though, S&P closed with distribution on the monthly, and Russell closed a big green bar. Look at that pattern that the Russell has been putting in though; one month green, one month red. It is crazy. What else am I to expect this month than a red monthly bar? Weekly chart on the Russell is showing some distribution though, a small amount but still some. Daily chart is what is making me ponder some short term upside though. It is just a nice clean, consolidation, actually textbook bull flag. On the flip side of things, there is more sell pressure than before one of these other runs the Russell has been making and I feel like if we did break out again (like on Tuesday) sellers would be waiting somewhere close to smack it down again. Levels I’ll be watching are; holding above Tuesday’s high or getting below Monday’s low. Any breakdown I would be looking toward the weekly 20ema as a target which coincides with the blue trend support on the daily. S&P is in a much different spot, two monthly distribution bars, weekly distribution and RSI divergence, bearish engulfing pattern (engulfed the distribution), and failure patterns everywhere. For any upside, it needs to get and hold above $1700. If It can’t do that I’ll be looking for the weekly 20ema to break and $1625 to be tested. **Note: The S&P & Dow Jones could very much cause the Russell and NASDAQ to break down**

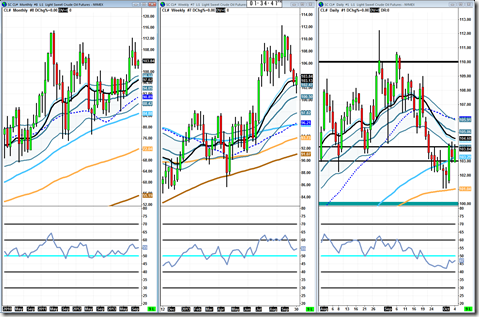

Crude Oil:

Like I said last week crude may need to pull down to $101 trend support to find some better footing and that is exactly what it did. It got some great accumulation off of that trend support and that is exactly the kind of stuff I look for. It is currently back above the blue trend support, next objective is to get through the 20ema and channel on the daily. If it can get going short term target is still $107-$108 area. Weekly and monthly aren’t looking like they will pose any problems for another big run. First signs that it isn’t ready to break through the 20ema will be failure on an intraday basis at those levels, either $104 support or the 20ema itself. If it comes off significantly (breaking $103), it may need to come back for another round of accumulation around the $101 support. So obviously $103 will be the key level I am watching this week for either continuation or more accumulation.

Gold:

Gold is definitely the easiest read out of all of them right now. Below $1320 is the weakness and breaking $1280 is the trigger. Everyone in the world is watching that $1280 level and if it cracks stops are going to be triggered, people are going to be bailing, shorts will be shorting, etc. Because everyone knows breaking that level could lead to new lows. I mean look at that weekly and monthly, those babies are ready for some downside action. The only way gold is going to redeem itself to me is getting and holding above $1350 like I said last week. I am more excited about downside though.

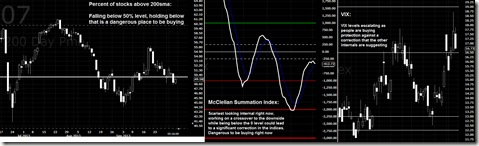

Market Internals:

I posted this on Stocktwits. McClellan Summation Index looks the worst and could reassure the other internals to continue into bearish territory. If it gets that crossover to the downside while being below 0, I would not even touch any fresh breakout on the Russell or NASDAQ because there is such a high probability they will fail. Especially with the percent of stocks above 200sma about to fall below 50% WHILE Russell is gearing up for a break. Nope, that smells like a retail trap and it smells like a place where the smart money is going to be unloading as they have been.

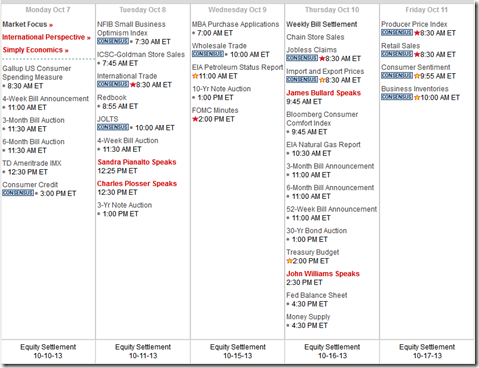

Economic Releases:

Highlight of the week is FOMC minutes from the “no taper” meeting. I am sure that will be exciting. I don’t even know what other releases are going to make it out with the shutdown.

Trade well,

-Michael