Stock Index Futures:

Last week I was talking about the range expansion taking place in the stock indices, I didn’t think that would lead to more upside initially but about mid-week I realized we probably would blast off to the upside. I posted about it on stock twits. Now, from here I have no idea how far we will go. Capitulation is the word you need to think of, bears are capitulating right now and bulls will wring their neck and squeeze them senseless for as long as they can. This chart is something I should have brought up last week, it is just a Russell 2000 weekly but using a line graph. From that perspective it is much clearer which direction we were headed, but it can still be used to see the context of this range expansion to the upside. Look at this NASDAQ monthly chart. The ranges are easier to compare on a weekly but I can’t fit it into one chart clearly. If this expansion to the upside continues, it is very possible we have something like the NASDAQ bubble of 2000 except this time it is going to be present in the Russell 2000 & S&P 500 as well. Think about it, everything is set up for a nice classic bubble. Yellen easy money forever and… well, I guess that’s all we need. Now granted, this could very well be the start of a blow off top (short-term or not I don’t know) but there is a lot of euphoria in the market right now and I think bulls will jump all over this for as long as they can.. this market has not been loosing them money, so why would they stop? So, I believe this is much different than the other rallies and if it keeps up we can see a lot higher as well as even more expansion. I’ll leave you with an expanded view of this monthly Russell chart, monstrous.

Crude Oil:

During the week I posted on stocktwits to watch the $100.5 level for a breakdown level, which worked but not like I was looking for. The new breakdown level is now $100 which may work better as that is a psychological level to be breaking down. If we do break down though I will still be watching that swing low from 9/30 at $101 for bulls to reclaim it which would be the first signs of bulls recovering. $104 is still the ultimate threshold. Breakdown target would likely be the 200sma and then I would be watching to see if price could reclaim the swing low, or at least attempt to. Other than that, daily 20sma and $103 key level is resistance if price tries to immediately rally into the week so watch that as well.

Gold:

Gold had a very solid setup for another leg lower but sellers couldn’t capitalize on that, so that should tell you something right there. Bulls aren’t in the clear until they reclaim $1350 like I have been saying for a while (can now accept $1340) and I also still say that below $1320 is bearish, but given the context of what happened last week if it can hold right at $1320 and consolidate that would be bullish and likely precede a break of those key levels. Something I have been looking at on gold though is this may be building a possible bottoming pattern which would explain the resilience to another leg lower. This two step bottom structure where price makes a higher low and would be confirmed when it takes out the $1400 high while continuing to make higher highs. It is a very real possibility. I’m not just throwing around theories here, I am aware of my parameters set by the daily structure, location and pressure along with the weekly trend resistance but the pattern remains the same. If $1400 is taken out I can seriously consider a bottom has been put in. Above $1340 key level, I would look for $1400 to be tested and below $1320 my hopes are not so good for bulls.

Market Internals:

I included some new ones this week so you can see the level of overbought the market is in and compare this to how price reacts this week. If price continues on with the action it is having now while these shorter term oscillators stay overbought, then we have a massive squeeze and big money buying everything in sight confirmed. What should happen is we get some kind of pullback or pause to calm the overbought reading before surging higher again. So use that as your baseline to compare the actual price action to.

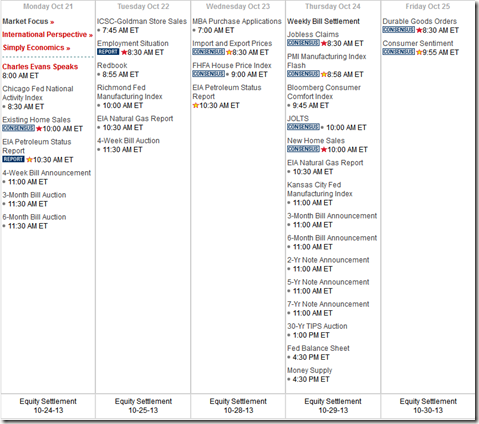

Economic Releases:

This week we will see a lot of numbers that weren’t released during the shut down. Some maybe have not been announced yet so we don’t know the date. But we do have employment numbers on Tuesday for September so that will definitely be the highlight of the week. Since it is on a Tuesday that may really bring out the volatility because typically jobs number Friday is a dull way to end the week, but this time around it is an exciting way to start the week. Also crude numbers on Monday. Existing Home Sales on Monday, Durable Goods on Friday, New Home Sales on Thursday.

On a side note, I have started on the next education piece regarding execution and building the trade plan (“Probabilities, Risk/Reward, & Trade Management”). It is going to be a long one because of it’s importance and likely take me a bit to write it but I have started working on it and am mostly finished with the first section being “Probabilities”.

Trade well,

-Michael