Stock Index Futures:

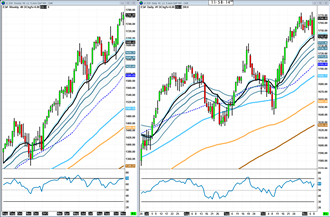

The thresholds that need to be given here should be quite easy to point out. On the Russell we are looking for $1110 to break higher and hold if price is looking to make new highs. For the S&P, the threshold is breaking and holding above that distribution ($1775) into new highs. If that does happen then something has changed, we never got the weekly test of the 20ema. It is definitely possible to smash into weekly overbought territory for a while. The flip side to upside thresholds is breaking and holding below $1740 on the S&P and $1075 on the Russell. You can’t deny those weekly candles are bullish though. I just want volatility back, so I am hoping that the distribution bars will hold and we can get a nice sell off. But if that doesn’t happen I am not going to dig in my heels just because I would prefer the market to go that way.

Crude Oil:

Crude oil is really not looking too hot right now. That $95 key level is acting as good resistance and if it cant get back through it, the next level is $92. If it can get through $95, I would be looking for a test of the daily 20ema and/or $97.5 key level. Weekly chart printed a bit of accumulation on the support level, but I am not sure that is enough. I will need to see more confirmation of buyers stepping in before I start looking for real bullishness on the daily chart. Keep in mind though, the weekly and monthly chart trends are still very much in tact for now. That means nothing without the daily chart confirmation bullish activity though, just something to keep in the back of your mind.

Gold:

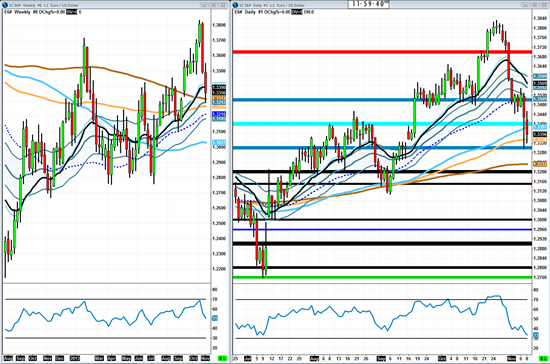

Gold couldn’t get back above the $1320 key level and is now about $5 from breaking down below $1280 and that really could trigger some serious selling since this is the second time we have been in this scenario. The first time just turned out to be a stop run, and now that all the retail traders are scared to take this setup a second time, this is likely the one that works and works well. $1280 is still a level that should be given great importance though. I should probably add it as a key level, but I will have to check data going way back before I do that. Anyway, look at that weekly chart as well. The sellers are just overpowering any chance that bulls have at recovering. RSI is staying below 50 and the 20ema/channel support is really suppressing this market nicely. So watching $1280 for a breakdown would be a good idea I think.

Gold couldn’t get back above the $1320 key level and is now about $5 from breaking down below $1280 and that really could trigger some serious selling since this is the second time we have been in this scenario. The first time just turned out to be a stop run, and now that all the retail traders are scared to take this setup a second time, this is likely the one that works and works well. $1280 is still a level that should be given great importance though. I should probably add it as a key level, but I will have to check data going way back before I do that. Anyway, look at that weekly chart as well. The sellers are just overpowering any chance that bulls have at recovering. RSI is staying below 50 and the 20ema/channel support is really suppressing this market nicely. So watching $1280 for a breakdown would be a good idea I think.Euro Currency:

Well, another brutal week for the Euro due to a surprise rate cut or something. As of right now there is really no upside threshold that I think is reasonable to happen next week. What I will be watching is if the Euro can hold its long term trend support because if it can it still has a chance at resuming the uptrend. It could be a very long lasting one too if it could get the momentum going behind it. We haven’t been this oversold on the RSI since March; that is not a reason to buy, just something to pay attention to. The RSI usually doesn’t get this low on the Euro, at least since it has been a dead instrument. So, there is really no trade setup but I will just be monitoring how well it holds up against the long term trend support & watching for more accumulation at these levels.

Well, another brutal week for the Euro due to a surprise rate cut or something. As of right now there is really no upside threshold that I think is reasonable to happen next week. What I will be watching is if the Euro can hold its long term trend support because if it can it still has a chance at resuming the uptrend. It could be a very long lasting one too if it could get the momentum going behind it. We haven’t been this oversold on the RSI since March; that is not a reason to buy, just something to pay attention to. The RSI usually doesn’t get this low on the Euro, at least since it has been a dead instrument. So, there is really no trade setup but I will just be monitoring how well it holds up against the long term trend support & watching for more accumulation at these levels.Market Internals:

The VIX almost woke out of her coma this week, but the bulls kicked her in the face. Percent of stocks above 200sma and McClellan Summation Index are both turning lower. There is a lower wick on the percent above 200 at the 50% level, but the bull trap scenario I laid out on that indicator a while back is coming to fruition. If it breaks lower, we could really have a bear party and bring some volatility back into this market and there is nothing I want for Christmas more than that. As far as this week goes, I will be watching for the percent above 200 to stay below that blue moving average (89 period) so the bull trap will stay alive and well.

The VIX almost woke out of her coma this week, but the bulls kicked her in the face. Percent of stocks above 200sma and McClellan Summation Index are both turning lower. There is a lower wick on the percent above 200 at the 50% level, but the bull trap scenario I laid out on that indicator a while back is coming to fruition. If it breaks lower, we could really have a bear party and bring some volatility back into this market and there is nothing I want for Christmas more than that. As far as this week goes, I will be watching for the percent above 200 to stay below that blue moving average (89 period) so the bull trap will stay alive and well. Economic Releases:

Not much going on with the news release side of things this week. I guess we get to see how negative our trade deficit is, how terrible our treasury budget is looking, and how terrible industrial production continues to be, but those are things we already know. Looks like EIA Petroleum Report was moved to Thursday. I wonder what the market will decide it wants to trade on this week, QE perhaps?

Not much going on with the news release side of things this week. I guess we get to see how negative our trade deficit is, how terrible our treasury budget is looking, and how terrible industrial production continues to be, but those are things we already know. Looks like EIA Petroleum Report was moved to Thursday. I wonder what the market will decide it wants to trade on this week, QE perhaps? In case you missed it, I did put out the education piece on building a trade plan called Probabilities, Risk/Reward, & Trade Management. If you don’t yet have a trade plan, I highly recommend you not only read this but study it. Having a trade plan is the most important thing you could ever do in this business. I stress it because when I first started trading I was one of those that told myself, “I don’t need a damn plan, I can wing it. I’m smart enough.” Well that didn’t work out too well for me, not only that but when I actually tried to put one together I had no idea how to do it or even what I was trying to put together. Just like everything else, I had to learn it for myself what was important and what wasn’t so I am trying to give you a shortcut here. I hope it helps you.

Trade well,

-Michael