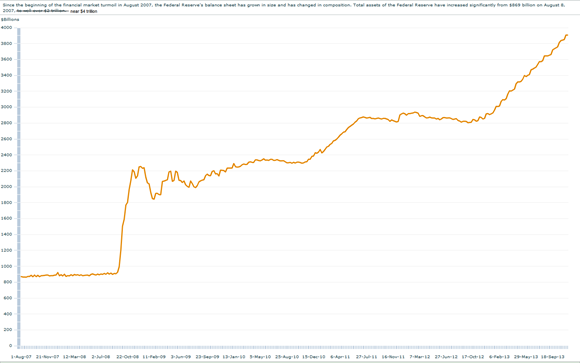

Many well respected people continuously criticize the people calling this market a bubble. I should only need to ask one question: Would this market be trading at this level if we had no QE? If the answer is no, then you agree that mal-investment is being made into equities therefore causing a mispricing of the stock market. The main argument is that there isn’t anything happening as huge as the housing market or the tech boom. Take a look at the Federal Reserve balance sheet, our deficit/trade deficit, unfunded liabilities plus the national debt, or the debt:GDP ratio.

Our government is broke and blind, believe it or not that is a problem to foreign and private bond holders. Our bond market is our economy. When the Fed is the buyer of last resort, that is the beginning of the end. What if banks had to stress test a big spike in interest rates? Well, we don’t know those results. I won’t harp on that anymore because I am sure most people understand the magnitude of these problems whether they want to blow it off or not.

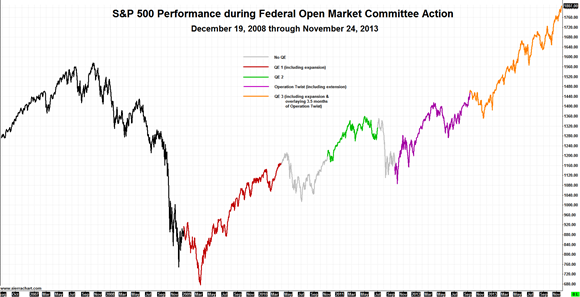

This blog is actually about looking at the QE specifically in the stock market, but other key markets related to QE as well. What I really find fascinating is looking at how the market has reacted to the first two QE’s, and how things have changed as the QE increases on all of these markets. Here is the chart of the stock market (clicking links to the original sized image):

The one thing I want to mention about this chart is to look at the drops that come after the end of the QE programs. We all have seen that before, but what I want you to think about is the massive QE binge that we have been on since Operation Twist started and how the market has been trading literally since that low. Now think about that in relation to what I was talking about in the first paragraph. If this QE ever ends, this market is going down and going down hardcore. Action, reaction. This action is so huge and has reaped such huge rewards there is no way it won’t come without consequence, this is not how economies work. Which is why it won’t end until the Fed has no choice. There won’t be any taper and on the off chance there is, it will come right back.

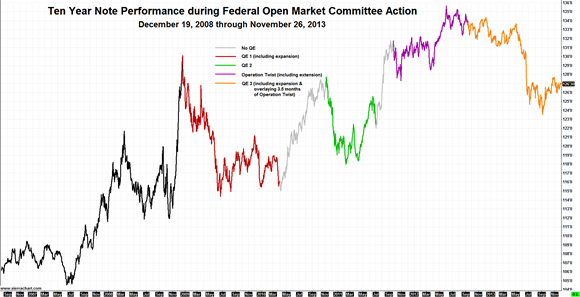

Now for the Ten Year Note:

I am not an expert on this but I will say it looks to me like the QE it having less effect especially considering we have been hitting the market hard since 2011 and rates actually have risen (bonds fell). I think people are finally starting to see the wishful thinking that most of the country is in, the stubborn nature of our government, and that QE will never end. This may be them selling to the Fed, but we still haven’t completely broken down.

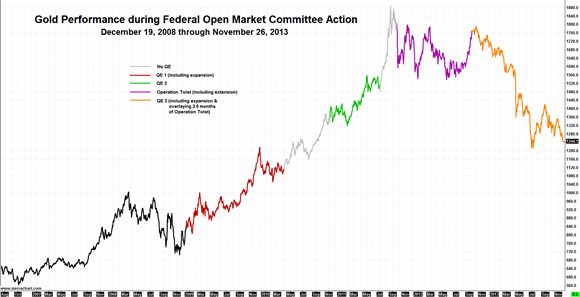

Next up is Gold:

I have no idea what the explanation for this is. I don’t believe it is a coincidence that gold topped out literally right when we started QE 3 and hasn’t looked back, but it is something very interesting to see visually like this. It could have something to do with the way the CPI is calculated in order for the Fed & government to look like it isn’t creating any rising prices.

Last but not least, the U.S. Dollar:

I was talking about this with someone on StockTwits, I think the QE is building up here and eventually it will be released in the form of foreigners selling their dollars or just people in general getting out of dollars causing a huge decline in the index. I think what we are seeing in the last two QE programs is the last rounding ‘hump’, you could call it, before the big decline. This is all happening in a huge monthly downtrend that I have posted about repeatedly in the weekly recaps. Think of it like drain-o building up in a pipe eating its way through the clog and when it breaks through it will whoosh through it.

You can call me a doom and gloomer, that is fine. I just look at the facts though. Sure companies can have good fundamentals due to the QE, but the big picture is what counts in the long term. We are five years and $4,000,000,000,000 into the long term. The magnitude of our big picture problems are almost unbelievable, and in no way even come close to equaling out with the short term gain or the good fundamentals of some companies and some cheap money for the richest people in the world. Of course as a trader, price is all that matters.. that goes without saying. I feel strongly about this stuff though because this is my future.

-Michael