Stock Index Futures:

I suppose it was inevitable after we got the range expansion in late October. I talked last week about breaking out of $1775 as a threshold to see new highs and sure enough we got it. I also said if that happened then something has changed in the markets because we didn’t get a real pullback before getting liftoff again. Now people are just buying the 20ema on the daily chart rather than the weekly, so we have kicked it up a notch. The range expansion may have kicked off a fairly large rally, so there really isn’t much else to say here except don’t dig in your heels. Embrace the rally, use stops, watch the 20ema on the daily as well as the RSI on the daily and weekly. As per you volatility lovers like myself, at least we aren’t covering miniscule ranges like we were in January/February, so who cares if we go up or down?

I would like to address (rant about) this bubble fiasco as well. I am in the camp that we are in a full blown bubble at this point. Why? Because ask yourself if the market would be at these levels if the fed weren’t in the market. If the answer is no (as mine is) then you agree that this asset class is in a bubble and that we are not in a real recovery but a recovery being propped up by the fed; a ‘recovery’ that can’t survive without the fed. If you want to lie to yourself and pretend like America is in some kind of ‘economic boom’ and live in the fantasy land with the rest of an Keynesians well then that is your decision to make. I don’t want to hear a list of 25 statistics proving that we are in some kind of economic boom because all I have to do is look at the middle class then look at Wall Street and the transfer of wealth is absolutely obvious. A transfer of wealth does not constitute economic boom, walling yourself into the corporate side of America and shouting “economic recovery!” does not constitute a recovery, telling me about how ‘strong’ our financial sector is because we have 0% interest rates, and how much debt Americans are going into so they can consume now does not create prosperity in the long term. My explanation for this market charging full speed ahead is the cheap money being provided to Wall Street for speculating, along with interest rates forcing people into equities, and the propaganda campaign by the media that our economy is in some kind of wonderful period in American history. Everything else you hear about is just people trying to justify why they are bidding this market up, it makes them feel a lot better about it.

Now that I said that, I should say this too. Don’t trade based on that. Trade based on what you see (on your charts) the majority of the market doing. If you see a bubble being built up and up and up then trade to the long side. Buy equities, join the party. There is no nobility in sitting out on a fortune, but don’t justify you doing it because of economic growth, because we all know that is a fallacy. Just be real and say you are doing it because there is a lot of momentum in this fed driven equity market. There is also no nobility in trading the wrong side of the trade, all you are doing is making yourself look like a fool while at the same time taking huge losses while everyone else is getting rich. If you truly believe that we are in a bubble as I do then just watch out for a long term top, meaning a top on the weekly charts. In the mean time, trade your plan and manage your risk.

Crude Oil:

Crude still really isn’t looking very good to me. Even if it gets above $95 there is a ton of trend support coming down on top of it. The weekly chart is showing some slight accumulation off of the trend support, but still the daily chart has a lot of work to do. $93 will be an important are for next week to break for more downside. Next key levels are the 3 at; $92, $90, & $88 so its possible we go mingle with those guys but at the same time the last trend support on the weekly is right below $92 so keep that in mind as well. We are at kind of a decision point in crude right now so I will just be waiting to see what road it takes.

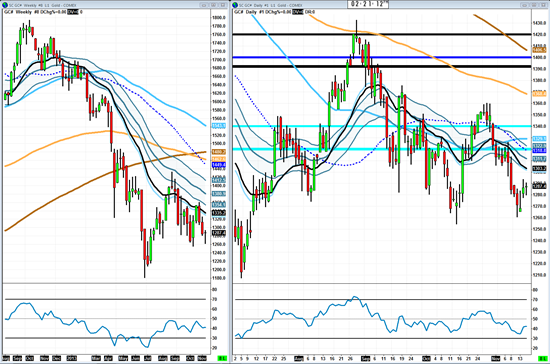

Gold:

I still hold to my thresholds that below $1320 is bearish and below $1280 is very bearish. It can’t seem to hold below $1280 for any period of time though. Weekly chart trend support still coming down like a ton of bricks and RSI still bearish on both time frames. I suppose we should be watching the swing low put in at $1260 now twice to break for more downside as well as watching the 20ema on the daily to get some bearish reaction as a confirmation of more downside to come. The structure on the weekly chart is also really bearish, so downside is much more probable in my opinion.

Euro Currency:

Euro getting some slight bullish reactions off of the daily and weekly trend supports. Will be watching 1.3500 for a break and hold above, that would be refreshing for bulls to see. Just the fact that it is getting some decent reactions across time frames should put some puff back in the bulls chest. That was a pretty steep drop though, so I wouldn’t be surprised to see some consolidation before heading higher, if it is going to head higher. I am not really interest in any downside action if it comes to that. Looking at the dollar index it should be clear why 1.3800 failed on the Euro; because that 79.000 band on the dollar is quite the strong one and if it gets below that there could be a very quick move down to 76.000. No trend support is in the way of the dollar either, in fact trend is pointing lower across time frames, especially the monthly.

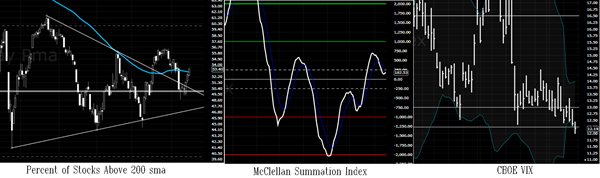

Market Internals:

Well stocks are holding things together on the internals. Percent above 200 is working its way back above the blue line, McClellan is turning back up and VIX is completely dead I mean no movement at all. Bollinger bands are squeezing on the VIX as well which historically has led to a pop in the VIX (as well as closing below the lower BB) but that was in a different market condition (before the range expansion kicked off a different kind of rally). Also every time we have approached this 12.25 level, some buy pressure comes into the VIX. Anyway, we will just have to see how this one plays out. I would consider the VIX most important to watch here being it has three signs that it should head higher, so lets see how it reacts to that.

Economic Releases:

Highlight of the week going to FOMC minutes on Wednesday. Other than that, CPI and PPI will be important numbers (for the Fed at least, I don’t believe in them). Retail sales, home sales, philli fed survey, business inventories, PMI, housing market index are all important stuff. We have a packed board this week so it should be a good one.

Trade well,

-Michael