Stock Index Futures:

So picking up from last week, we broke above the doji bar on Monday’s session and closed with a big wide range green bar smack into a liquidation area. Looking at that weekly chart though, it does look very attractive and the daily chart no longer looks like total crap. Still though, I believe in not being greedy and only trading solid signals and this really isn’t one of them yet. The fact that $1036 is yearly R3 is also lingering in my mind, even at the beginning of the year that was what I was looking at as the area of liquidation if we made it up here. The FOMC this Wednesday will ultimately decide it’s fate. This entire year has been Fed based. I still stand by my statement, that is a strong failure pattern up there at the highs. I have seen many, many stocks top out like that. Apple for example. But, at this point I am just waiting for reactions to either confirm my theory or disprove it. Divergences still present.

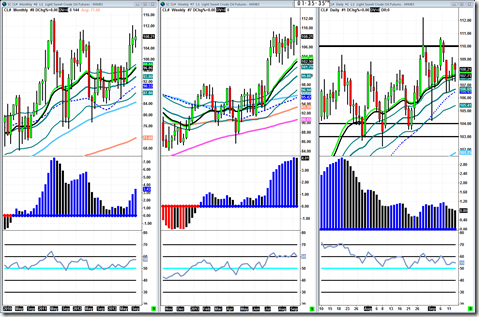

Crude Oil:

It is looking more and more like crude has found a range that it likes, aka price acceptance. I will be watching last weeks low, if it is broken $103-$104 support is very possible. If it holds it is very possible that crude is making a small base between $107-$110 before breaking out to the upside. The ideal situation for bulls at this point would be to breakout above $110 again and actually hold/consolidate above it to make another move higher (which is what I thought it was attempting to do last week). Weekly and monthly indicators are still in trend mode. There isn’t much more to say about crude at this point.

Gold:

Like I said last week, if resistance levels start getting sold it is time to remember where we are on the weekly chart. That is what ended up playing out and I gave a midweek update on stock twits saying that the bullish reactions just weren’t cutting it for the context that price was in. Now it is below $1320 which is a very pivotal level. As long as it stays below $1320 we could even possibly see new lows. Weekly trigger has even turned back red, the long term downtrend has come back with a roar. At this point, gold has pretty much screwed itself. Even if it does rally back above $1320 there are so many resistance levels that bears will have a field day stopping out the longs and driving it back below $1320. If you draw a box from 5-20 low to 6-03 high on the weekly and extend it over, that is a classic sell signal zone people use all the time. That is all this move back up is shaping up to be as it stands right now. That weekly 20ema is also going to be a brick wall now that it has failed. At this point I would be looking for sell signals.

Market Internals:

Internals are still looking very weak, which is another reason I am skeptical of another move up. These first two market internals are very much forward looking. I encourage you to study and backtest them.

Internals are still looking very weak, which is another reason I am skeptical of another move up. These first two market internals are very much forward looking. I encourage you to study and backtest them.Economic Releases:

Obviously the highlight of the week is FOMC day Wednesday @ 2:00pm EST. On top of that there are important data points coming out all week, including CPI which will be interpreted to have a direct impact on the FOMC day potentially causing big market moves. It should be a great week of trading, as last week was very much a dud.

I plan on doing my next education piece pretty soon.

Take it easy and happy trading to everyone,

-Michael