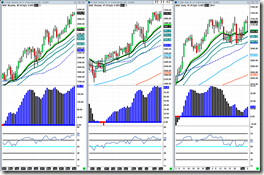

Stock Index Futures:

Looking at all 4 indices, they are showing different signs of strength. The Dow is the weakest, Russell and S&P are still pretty indecisive, and Nasdaq is the strongest. I am just going to talk about S&P & Russell as usual. Last week I was talking about how the market needs to prove itself by showing signs that buyers are coming in on the daily chart. It still really hasn’t convinced me of anything but there are two things that caught my attention. First, we have been consolidating at this level for a while without breaking down. Second, Friday’s action was pretty bullish intraday if you don’t pay any attention to the news that caused it. However, Friday’s action was also a huge doji, giving some breakout/breakdown levels to watch for next week. Above Friday’s high would be sending the markets straight into a liquidation area, so if I was to see any type of distribution bars that is nearly a sure sign people want out at that level around $1680-$1700 and I would be one of them. Also look at the RSI on ES weekly chart along with the trigger. Both showing strong divergences being acted on. Below Friday’s low is where the bear party comes into play. Nothing but air below to $1600 and below that $1565. With all this Syria uncertainty and technical weakness, it wouldn’t surprise me. For the Russell, the next level is $1000 then $975. I think after consolidating above $1000 for so long, if it were to break down I think that would turn into resistance and I would be targeting $975.

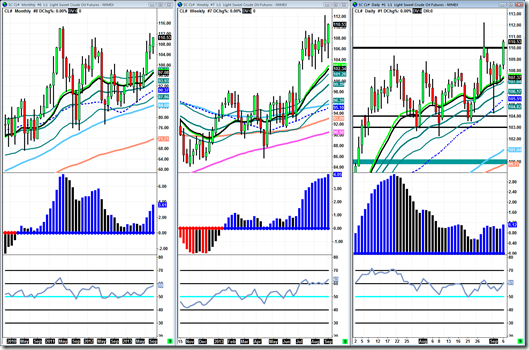

Crude Oil:

Crude has really handled up on that distribution bar printed last week. It got a strong close into more than 50% of it, creating huge accumulation at the same time and that is a good sign. Indicators all still bullish. Only thing I am going to be looking for is a break and close above the distribution. It may need to build up some pressure near the highs of it but however it does it, it needs to happen. Not something to worry too much about though since price structure is so nearly perfect. I said a few weeks ago that after that huge consolidation under $110 I think that would turn into support rather than act as resistance at this point and I think that is what is happening right now. That could be the support level crude needs to build up the pressure to bust through that distribution level. So, I will be watching that level to hold this week. If on the off chance it doesn’t hold, there are support levels everywhere. 20ema, channel support, 50sma, & 104-103 key support. That makes the path of least resistance to the upside, and that is what the market looks for. On a bit of a longer term note (or maybe not), this accumulation base crude is trying to break out from could be the launching pad up to $120 or higher.

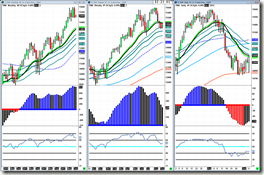

Gold:

Gold is a tough read here. On the weekly chart gold is printing distribution at previous distribution levels and resistance. But on the daily chart, we have strong bullish reactions off of support levels and the 50sma turning back to the upside. I really can’t get very bearish on gold unless we were to break back below $1320. There is a lot of support in between the last traded price and $1320. I am leaning more on the bullish side of gold and I don’t feel like those weekly distribution bars are going to pose a huge problem, though they do need to be closed above. Last weeks bar was actually a doji, showing both accumulation and distribution. Anyway, the best thing to do here to get a better read is watch the reactions off the the support and resistance levels. If we keep getting price action like we are now off of support levels then there is no reason to stop being bullish. But if resistance levels are starting to get sold then it may be time to remember where we are on that weekly chart.

Treasuries:

I just wanted to make a quick point on the 10 year note. This is bearish. See the rounded continuation pattern on the daily, that is bearish. We got a pop on Friday and it was a pop right into resistance that got sold into. They actually did some front running and sold it before it even got to the resistance. Next support levels on the daily are 122’22, 121’23, 121’15. Indicators are all in downtrend mode as well as price action, there is no reason to fight it.

Market Internals:

I drew a downtrend line on the percent above 200 indicator because I feel like it is going to stay in that downtrend until the market has a significant sell off and that indicator goes down to 20%. These indicators combined with the weak price action are what have me in the bear camp right now, at a minimum not in the bull camp. I feel like the market needs to be refreshed, and these indicators are screaming at me that my feeling is right.

Not much going on until Thursday and more importantly Friday. This week is probably going to be trading purely on news about Syria and market sentiment about Syria. I don’t think the market likes it. The market knows that no one else in the world is for the U.S. to invade Syria with little to no evidence on our reasoning. The market knows that we can’t afford it as a nation, that other countries will likely be there to help Syria, and could realistically spur into WW3.

You probably noticed I made a few small changes. I changed the color of the trigger and took out the stochastic on the bottom. I did that so I could have heavier emphasis on the RSI. The stochastic was there to give specific signals, but I know exactly what those signals look like on the price action so I gave it the boot. I don’t like having anything on my charts that I don’t absolutely need anymore. Plus the RSI and the trigger make a good team for indicating strength of a trend, and I have a lot of experience with the RSI and know a lot of nuances with it. I changed the color just because loosing momentum on the upside or downside really doesn’t need to be differentiated. It is indicating the trend is loosing momentum and that is the same on either side so I made it the same color, black. Everything else is the same and will likely stay that way.

Take it easy and happy trading to everyone,

-Michael