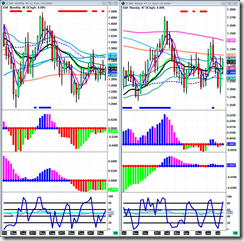

Stock Index Futures:

Link for large Russell chart Link for large S&P chart

Link for large Russell chart Link for large S&P chartFirst I would like to say, this has been a hell of a bull market. Secondly, the last rally that resembled this type of straight up action was April-May and it lasted 4 weeks. We just closed on the 4th week on Friday, so that is just something to be aware of if we start seeing distribution signals this week on the daily. The weekly divergence on the Russell turned into a failed divergence but the S&P just gave a whole new divergence to start looking at, both on the daily and weekly. Both daily and weekly divergences need to turn magenta for them to be confirmed but it’s a high probability they will. The daily divergence is on the slow trigger and weekly is on the fast trigger, which makes sense because the triggers are looking at multiple time frames and the slow trigger of one time frame is the fast trigger of the next higher up time frame. With all that being said, there is still no sign of slow down on even the daily chart and if we go another week like this, we could very well be having a blow off month or be in the making of a bubble in small caps though that is a long shot, but anything is possible. I don’t know how else to explain it, the economy is stagnant and the only thing keeping the market going is the fed. I’d love to see the fed explain a small cap bubble they caused. So, what I am watching this week on stock indices is normal for these bull moves – distribution for sell pressure & fast averages (daily initial price momentum) for continuation.

Crude oil:

Well crude is definitely holding up its end of the bargain. Another week in the green with some strong indications. My only problem is the magenta that showed up on Friday’s bar, confirmation of a correction will come when we get under the fast averages. If that doesn’t happen then I’m looking to test and maybe even break $110. On a weekly and monthly basis it couldn’t look better, which is why I don’t mind a daily pullback to get some new buyers interested. Something I look at in emerging trends is the slow trigger on the weekly and daily. Both of them are in top shape, especially that weekly. It went from a slow start to a steep slope, and that is perfect. When crude gets going like this it really likes to go fast unlike stock index futures. Bottom line: everything is perfect from a trend perspective across all timeframes.

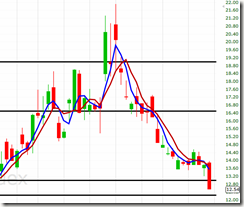

Gold:

Gold starting to feel like some buying pressure is emerging at these low levels. There is a classic sell signal on the weekly chart so we will see this week if the sellers are still selling, and if they aren't it might be time to buy. I still believe it is going to take a multi month base down here before any real traction can get going to the upside kind of like Apple has been doing. But another classic trade here aside from the stochastic sell signal is in a downtrend once price gets above initial price momentum it tends to want to test the immediate backup (20ema). So that could possibly happen over the next week or two, and the backup is at $1400. These are usually fairly quick moves too. The sell signal triggers under last week’s low or under the initial price momentum depending on your level of aggressiveness. The buy signal triggers above last weeks high but be conscious of all the resistance levels in the way on the daily. Higher time frames are suppose to override lower but this trend is strong for the time being, we are just in the earliest stages of buy pressure.

Treasuries:

The treasuries did a good job holding above the 125 support level, which is also right around the long term trend support on the monthly chart. That candle pattern on the weekly is a common pattern you see near bottoms though one more accumulation bar would have been better. Same as gold there is a classic weekly stochastic sell signal which would trigger either below the low of last week or below initial price momentum depending on your aggressiveness level. The long signal to test the long term trend support from below / immediate backup would be above last weeks high. So we will see if the sellers are still selling or if the fed has got that under control. Same as gold there is plenty of resistance to the upside on the daily chart which may alter the results of the weekly buy signal above last weeks high.

Euro currency:

I wanted to add the euro this week to the weekly recap because of the weekly chart. Those that read what I have completed so far in the Education series see exactly what I see. The weekly long term trend support are all in order suppressing price below 1.34 and acting as strong resistance and the weight of the market on the monthly chart is trending lower. This makes for a high probability sell off after breaking below 1.2750. Realistically it could fall all the way down to 1.2100-1.2000 before finding any support. The reason I give it the 1.2750 threshold is because it has been finding support there several times (skipping rock theory = after hitting a support so many times it will eventually stop holding) and because the moving averages I do have enough data for on the monthly are somewhat upward sloping. But the cleaner picture between the monthly and weekly is definitely the weekly chart, so 1.2750 is a good medium giving credit to both time frames.

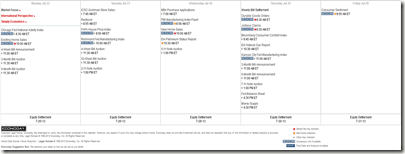

Economic Releases for the Week:

Nothing too heavy lined up for this week, but since last week was such a quiet one for OPEX I would expect some activity to come back into the market this week. I expect people will be anxious to see what the crude oil inventories are, though I will put more importance on the trend. It could be an excuse to sell even if there are bullish numbers, which would be good for throwing off junior traders and giving bears a chest pounding only to stick it to them after realizing it was only a retracement in an uptrend.

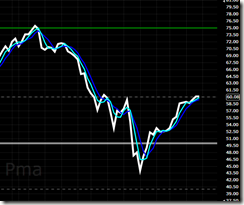

Stock Index Market Internals:

Link for Percent of Stocks Above 200 sma -- Link for McClellan Summation Index -- Link for CBOE VIX Index -- Link for charting source of internals

Market internals are still looking pretty bullish overall as percent of stocks above 200sma is grinding higher along with McClellan summation index turned up and VIX with a massive plunge. However, with the way the broad market index like the Russell 2000 is rallying I would expect to see the percent of stocks above 200sma at a much steeper angle to the upside given that is including about 4000-5000 stocks. What that is telling me is that the 2000 stocks in the Russell are way outperforming the other 3000 stocks that are traded on the main exchanges. Also the divergence both %>200 and summation index will put in once the market goes into another correction will be massive. These are things to pay attention to. If you are going to start following these internals, I highly suggest using the link provided above. Worden calculates these in a way that they lead the market and really give a much better picture of what is going on compared to most software online. It is also free, so there is no reason not to follow them.

Take it easy and happy trading to everyone,

-Michael