Using 130m charts this weekend rather than daily because I think they present a more clear picture of what's going on. The S&P is looking the most vulnerable here with the false breakout that has now been back tested and failed again. $210 is a trigger level for sellers to get below since that would be a lower low after a lower high. That's also where the 50 day average is. The Russell, like NASDAQ, has the 130m trend potential to hold to the upside. The goal there would be to get price action out of this wedge and above $125 to head towards the highs. If sellers take it lower it's only a short distance back into major support at YTD break even/$120. I still have no interest in the short side of the indices from where we are currently.

So it's safe to say there are still some majorly mixed messages coming from this market overall right now, and it's just best to wait for more clear price action and be selective in the positions you open. Taking it one day at a time and knowing the blueprint of what you are looking at. I haven't been tweeting really at all because I haven't been seeing anything either positive or negative to bring up. Just being patient and riding this out with a select few long and short positions. If things start lining up then I'll get more active on the tweets.

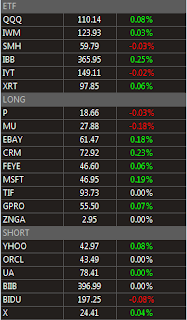

Still giving equal attention to both long and short ideas in the watch list. EBAY, FEYE, and GPRO have been the majority of my long side focus. ORCL, YHOO, and BIIB as my short side focus. The watch list last weekend was way too large so I cleaned that up pretty quickly, but the long/short message is still the same.

A market like this is weeding out the people who can't or don't manage their risk. You see it everywhere on the streams. The market will come out of this funk whether it's to the upside or downside and only the people with bullets left to fire and the confidence to fire them will be the ones playing the game. And I plan to be one of those people. Thanks for reading

-Michael