Stock Index Futures:

Is it a bubble yet? There was hardly any pullback and it is already trying to go again. At some point this stops being a bull market and becomes a bubble. That point is when we are printing monthly bars like July just did and they continue to be that large and get even larger. The QE bubble? Seems logical. Anyway, I am sure I mentioned last weeks weekly bar was a buy signal and it was bought. So buyers are still buying and there are no signs of distribution that haven’t already been broken above. Also note that the Russell is above yearly R3 at 1036 and everything is still bullish. The only reason to sell is to take profits. There really isn’t much to update about at this point in the stock index futures. Buyers are buying, still. Internals are far from confirming this by the way, but those aren’t presenting a serious problem at this point.

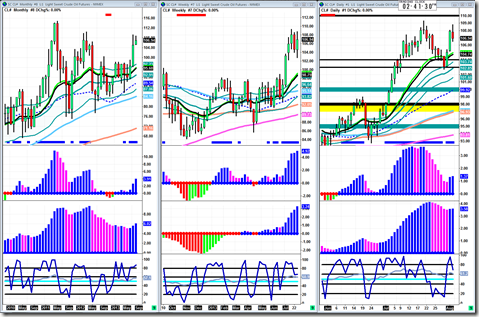

Crude Oil:

I know for sure I mentioned last week that weekly candle was a buy signal. It was bought. So just as the stock index futures, buyers are buying. Also the 103-104 support area held perfectly. This isn’t magic, these were plotted when crude was around $101. I posted a chart on stock twits right when I plotted them if you want to go look at that. I will get around to doing that blog on those. Anyway, a pullback to the daily 20ema wouldn’t surprise me. At that point I’d like to see it hold, maybe give some accumulation signals on a lower time frame as discussed in Using Multiple Time Frames for Day and Swing Trading educational piece I did. That $109 area keeps printing distribution, so people are selling into that level. Buyers are going to have to build up strength to break through it if they want to keep this train rolling. The chart is still bullish though, that V shape on the daily isn’t a sign of weakness. Furthermore, technically that daily candle is a buy signal. Weekly and monthly charts are still looking great, nothing changed there.

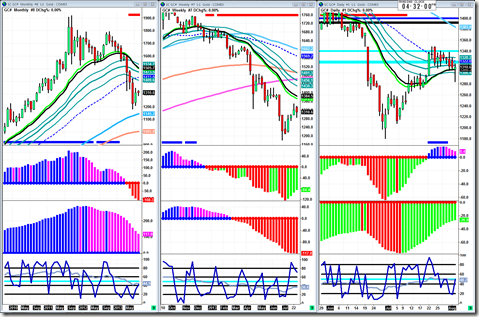

Gold:

The first thing I’ll say here is that monthly bar is a pure and simple sell signal. Last weeks sell signal was sold at first until the bulls came in Friday and really tore it up on the job numbers. Bulls gave a good accumulation bar on Friday to work with, but gold is still a very “iffy” situation. No real clear direction now that buyers have started to come in but sellers are still in control. In the middle of the week I checked the weekly slow trigger and it had turned green, but sellers caused it to stay red. Monthly chart shows bears clearly in control with $1145 as a reasonable target, while the weekly chart is in a downtrend with a red slow trigger giving credit to sellers below last weeks low, and the daily chart got trapped in a key daily resistance level while still in a downtrend. So, $1385 can be a reasonable target above $1340 key resistance level and below Friday’s accumulation bar there is nothing but air and could even see new lows.

Treasuries:

Well, 10 year notes are definitely trying to build a bottom or something like that. The daily chart just looks heavy to me. But, I can’t argue with the weekly or monthly charts showing buyers. So what I will say about this is, below 125 is bearish territory. Even though weekly and monthly (mainly weekly) price action is showing buyers, the indicators are showing sellers. I did mention before that we could start to see the bouncing effect here causing a huge roll over in the bond market. If they popped up to the 129 level on the weekly chart that would be smacking right into two important resistance levels and on top of the the daily charts are already showing a strong downtrend. You can read more about the bouncing effect here. It is very real, and this weekly chart is a perfect candidate for that to happen. The only trades I would be taking here is below 125 on a swing trade basis, and even then I would need to see a weekly bar close below there. Bond managers are fooling themselves if they don’t believe the path of least resistance is to the downside.

Market Internals:

We can all see the divergences loud and clear. My worry is when they get below the midpoint (50% & 0 lines) and stay there. For now they are holding up and that is why I said they aren’t posing a problem. But, one more sell off and these guys will be below the midpoint and that means big trouble for the markets. Especially a very quick, rapid, selloff. Even one or two days of that kind of price action could bury these indicators.

Economic Releases:

Not a whole lot of news this week. Hopefully we get some decent price action though while digesting that mountain of data we got last week.

Take it easy and happy trading to everyone,

-Michael