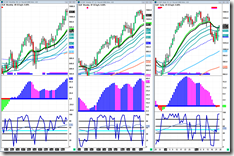

Stock Index Futures:

I wanted to post all four this week because they are all showing different price action. Russell is showing more strength then the rest of them overall, Dow Jones is showing the most weakness, Nasdaq is showing no failure pattern at all, and the S&P is just showing a stronger version of the Dow Jones. It is a mixed bag right now, and they all need to converge into one direction and that will be the confirmation. The failure patterns are still a big focus point of mine. I think that area represents heavy selling, but there is still something that we can’t overlook. That would be the stochastic buy signal that is being bought on the weekly charts especially on the Russell 2000. However, we also can note that on the S&P weekly chart, the divergence is playing out so far. I have been saying that if we do get back into the 1680-1700 area that I would be looking for a bearish reaction and that is still the case. That would be 1040-1060 for the Russell. If we did get back into that area, that would be enough to justify the weekly buy signal being bought and if there was some bearish reaction I think all those buyers would bail also justifying the heavy selling in those failure patterns.

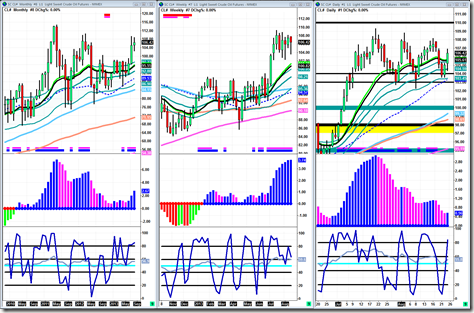

Crude Oil:

Crude oil is still looking great as I have been saying all year. These past 6 or 7 weeks have just been a healthy consolidation after a vicious up move. Many people want to spin this into distribution or whatever but don’t listen to that junk. This is an uptrend on every time frame showing accumulation on both the daily and weekly charts. Let’s say hypothetically if we were to go lower from here which is a very low probability, there is support at 102, 101, 100, 99, 98, 97.50, 95… you get the point. Support is everywhere and it has already battled to get out of that cluster of support and has decided which direction it is going in. The only resistance above is 110 and I think crude will turn that into support as well. So, as far as the update goes.. everything still looks great and am just waiting on the continuation now.

Gold:

I am very impressed with how gold has been acting toward the bulls. Speculators covering their shorts, even reversing their positions, and physical holders buying all they can is making for a nice rally. One more week and this monthly bar closes another step closer to a V shape reversal. As far as this week goes, if 1400 is broken 1420 is next up right behind it. I think 1420 will be a very strong resistance level if 1400 is broken. The light blue long term trend support was proven this week as solid support, so if gold can consolidate above it for a bit while it curls beneath it providing even more support that would make for a perfect launching pad for bulls to use. That would mean gold holding above 1375-1350 for a good while, a few weeks at least. For now all we can do is level trade it, and those are the levels I will be watching.

Market Internals:

Internals are trying to recover themselves but still very damaged. Percent of stocks above 200sma is rounding off which can be very bearish if a new high isn’t made. The same goes for McClellan Summation Index, if a new high can’t be made above that one made around 500, that is very bearish as well. Volatility is loosing steam which isn’t something I like to see. Overall I feel the two directional internals are getting very heavy and doing so at levels that bulls can’t afford to loose.

Economic Releases:

This week looks good, should keep the markets happy and moving. GDP is the highlight for the week.

You may have noticed that I changed my trigger setup. All I did was merge the two triggers into one.. price is either gaining steam or loosing steam, right? No need for two.

Take it easy and happy trading to everyone,

-Michael