Stock Index Futures:

On last weeks recap I mentioned the failure patterns in the indices and looking for the daily 20ema to be broken to see how price reacts to the midpoint of the channel support. Price broke through it like it wasn’t even there, that tells me there is some real weakness here. Next level to be watching on the Russell is the 50sma on the daily charts (S&P already slightly broke 50sma) and after that $990 area. I do expect the weakness to continue this week as the market internals are showing no signs of life, those will be posted at the end. $1625 will be an important area to watch as it is daily long term trend support level and weekly 20ema. Something I just noticed this weekend is that failure pattern I have been talking about also is happening on the weekly chart of the S&P. If you draw a line from the May highs you will see price broke above it for a short period of time, couldn’t hold, and failed just like it did on the daily chart. If that $1625 level fails I will be watching $1600 then $1580 for reactions. Also note that S&P weekly divergence is playing out as well as daily indicators going negative. Even monthly fast trigger is starting to show early signs of weakness.

Crude Oil:

Another good looking week in crude oil. Mainly just a slow drift higher and there is nothing wrong with that given the context it is in. The weekly chart is really what I am looking at here for more buy pressure to come in. I think after a base being built below $110 as it has done that $110 level will be broken through and likely act as support. All the triggers and indicators on all time frames are still looking great as well as the trends. $108 will be the level that needs to be broken above and held to see higher prices. Intraday rebounds or dip buyers have been happening over and over again typically in the afternoon so that tells me buyers are still interested. I am now watching for some wide range activity in crude and some nice intraday trends to trade to the upside.

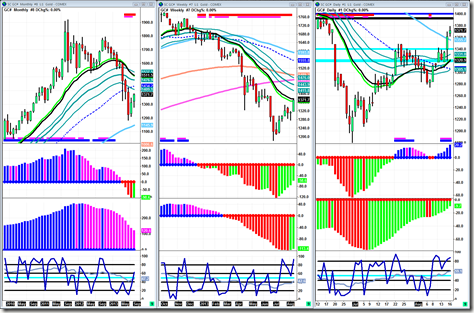

Gold:

Well bulls gave an impressive show this week of strength. As was mentioned last week I said I would be watching for the $1340 resistance to be broken to get a test of $1370 which is exactly what happened. It stopped right at the $1370 weekly 20ema level while also repairing the triggers further. The monthly fast trigger is green as it stands right now and honestly if this price action continues we could really see the V shape reversal I have been saying could happen. But we aren’t there yet. Next levels bulls will have to deal with is still the weekly 20ema and next $1390-$1400 resistance levels. Daily triggers look great as well for some added confirmation. Now at least bulls have some support levels below at $1340. I really wouldn’t be surprised to see price consolidate between $1400 & $1340 either. If they do break through $1400 level though, I really don’t expect $1420 to be broken immediately being that it is a key resistance level and there is long term trend support falling on top of it. So those are some levels to pay attention to. Another thing looking out a bit further, if bulls can regain $1475-$1500, they can potentially save the weekly long term trend support structure and start to rebuild the daily long term trend support as well as continue to build the monthly V shape reversal. Just a thought for a longer term perspective.

Treasuries:

I think I have been quite clear on the fact that notes look like trash. Still do, but they look like gold to traders who don’t have a long bias. People that trade with no emotions unlike these bond managers that live in la-la land. Anyway, 125 is still a key level that needs to be broken as well as the July 8th low to see lower prices. Next key daily support level is 122 22/32. Weekly triggers and sell signals are still being sold aggressively. I honestly believe longer term bonds can see a lot lower, in the 119s. For now I will just be watching for July 8th low to be broken so we can see 122 22/32 in a jiffy. Keepin’ it real..

Euro Currency:

I wanted to include the Euro this week because of the very interesting spot it’s in. 1.3400 is a key level but it is also the weekly long term trend support level. Obviously there is more data for the dollar so I like to take a look at that as well when doing Euro analysis, and the dollar is in a strong long term down trend. I will post the chart after this. So, if 1.3400 gets broken I am going to be watching for 1.3500 to be broken as well at which point there is fairly open air up to 1.3700-1.3800. This would be very good for gold since bonds, dollar & equities will be falling as crude is rallying. It might also possibly wake up some politicians if this scenario were to play out. Also think about that for a second. Bonds, dollar, and equities falling as crude and gold are rising… conspiracy theory? Anyway, triggers across the time frames are also set up for a break of 1.3400, so it isn’t unlikely that it will happen.

U.S. Dollar:

I’m only posting this for Euro analysis purposes, but you can clearly see the downtrend on the monthly chart I am talking about. Now obviously the weekly poses a slight problem, but it isn’t nearly as long term as the monthly. Also the monthly chart is getting bearish reactions off of the resistance levels. By the time it gets to 79.000 anyway it will be below all of the weekly long term trends if it were to get there. I don’t see this chart screaming bullish to me anyway. Triggers are also overall bearish.

Market Internals:

It really seems to me that a lot of people discount these internals especially the first two. If the market is rallying, and these first two internals are below the midpoints.. that is really bad news. With the scenario I wrote about in the Euro & U.S. Dollar analysis possibly happening at the same time these internals are heading below their midpoints, I mean, the ducks are aligning quickly. I suppose they could still bounce from here, but if the midpoints start acting as resistance that is just screaming to get out or watch for a crash of some type. If we just slam through the midpoints quickly well that is probably because the market is going to be having a very fast brutal selloff similar to the flash crash or U.S. credit downgrade in 2011. They are important whether you watch them or not.

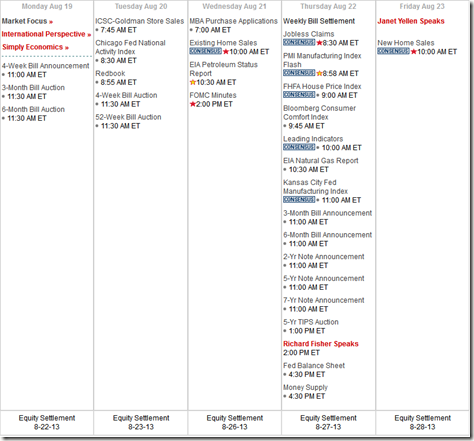

Economic Releases:

FOMC minutes is the highlight this week. Yellen is speaking on Friday as well, which should scare the markets nicely.Take it easy and happy trading to everyone,

-Michael