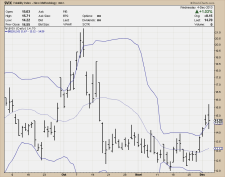

There are so many factors to look at to explain why the volatility is coming into the market this month; end of year selling after large gains, Fed December meeting/taper scare, VIX Bollinger squeeze being released, daily chart distribution, daily chart wedge broken to the downside, jobs numbers & on top of all of this market participants are actually embracing a correction possibility for the various reasons they want to see one which makes it more likely to happen and follow through.

This is the squeeze I wrote about in the blog post “Looking Inside…” and when I wrote that post I was kind of scared that it was either just going to peter out or hit the top band and roll over to the downside causing the bands to expand and invalidating the squeeze. It didn’t though, it is firing off exactly as I had hoped and I don’t think it is finished yet. Pay attention to that top Bollinger band as it is important to the squeeze, price should be hugging that thing for as long as the squeeze is in effect. I wanted to mention the squeeze first because it is firing off at the most perfect time.

![ESZ3 [C] Daily #1 41612.901 ESZ3 [C] Daily #1 41612.901](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjHgIYR1QtL4OI0eEIZvc5UzXXSNZ_jHgCTP5ba87z4EINW3gWXFJgOi6hgXeo8M0TbAM0jx8b5qyhDcTZYvhRr155CKlMeuVgN-ZbndKDbjGKHAYtGfW09I_feHU98oScP061w3yCoihM/?imgmax=800)

The fact that the VIX is firing off as we are breaking down from this wedge makes it even better. We still have plenty of room until we see the 50 SMA again ($1740). I just can’t see price getting back through that until a correction plays out, especially with the jobs numbers coming up and the Fed meeting in two weeks that the entire world (literally) is waiting on. The fallacy that they are going to taper is just what the market needs to get some juices flowing through it rather than some drone slow grind up. What would be even better is if they did taper, but I am not counting on it. Volume is also increasing at a fast pace (confirming the volatility coming back) after seeing the lowest volume all year last week. So, obviously I am pretty excited and now you know what I am paying attention to.

You will also want to be watching how price reacts to today’s low ($1780). Ideally I don’t want price to hold that from a volatility perspective, or at least holding below $1800 while still keeping volume high. This morning I noticed how quickly the open range was established, meaning there were lots of orders at the open so pay attention at how fast price is ticking at the open and that can be good information for the coming session. We were also getting a lot of +1000/-1000 TICK readings so pay attention to that as well intraday.

Trade well,

-Michael